2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

Feb, 25 2025

Feb, 25 2025

Crypto Crime Measurement Calculator

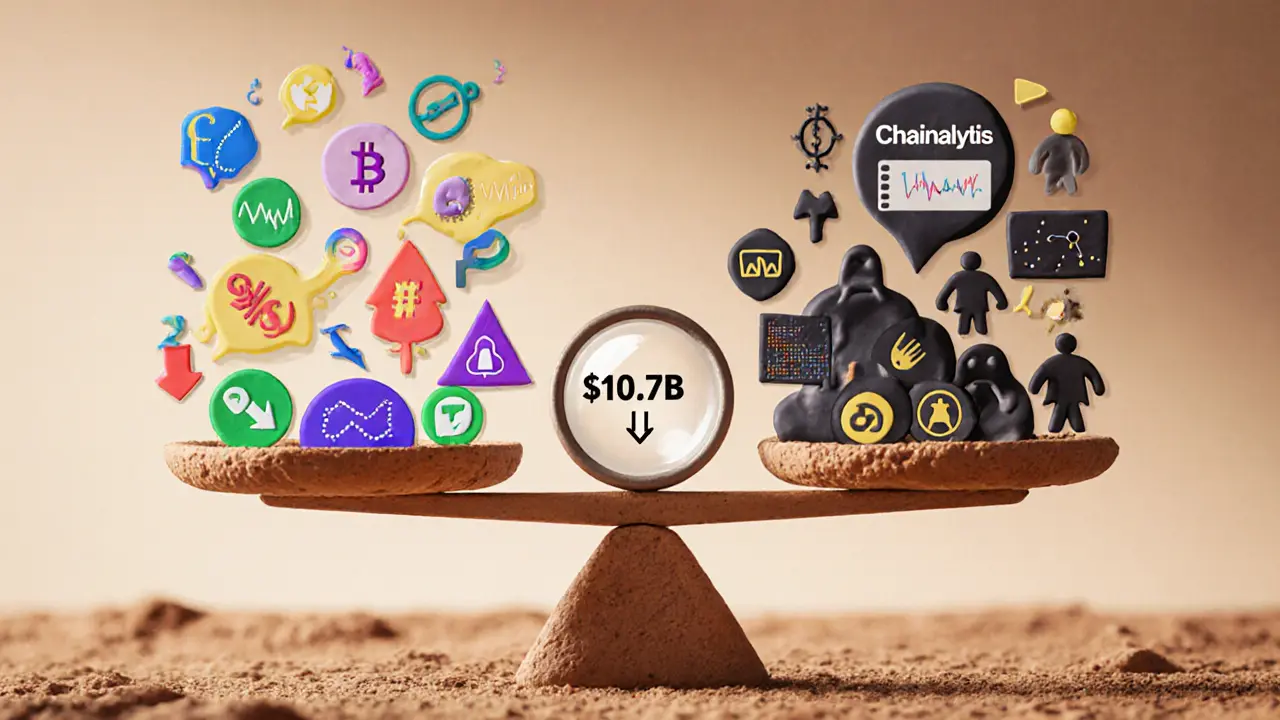

The numbers about crypto crime can be confusing. TRM Labs reported $10.7B in illicit activity while Chainalysis reported $40.9B. Why such a huge difference? It's all about what's being measured. This calculator shows how different measurement approaches affect reported crime amounts.

Fraud-Focused Approach (TRM Labs)

Measures scam-related activity: phishing, fake exchanges, pump-and-dump schemes, and other fraud. More relevant to everyday users.

Broad Illicit Approach (Chainalysis)

Measures all illegal activity: ransomware payments, darknet markets, money laundering, terrorist financing, and sanctioned transfers.

The difference between these measurements reflects what's actually being tracked. TRM Labs focuses on scam activity that affects everyday users. Chainalysis tracks the entire illicit ecosystem, which includes activities that often get discovered later (like darknet markets and money laundering).

As the article explains, Chainalysis admitted their 2024 estimate jumped from $24.2B to $40.9B after refining their methodology. This shows how measurement approaches change the numbers.

By early 2025, the global crypto enforcement landscape had shifted from panic to precision. The numbers tell a complicated story: while some reports show crypto crime dropping sharply, others say it’s climbing. The truth? It’s not one or the other. It’s about what’s being measured - and who’s doing the measuring.

Two Different Worlds of Crypto Crime Data

TRM Labs and Chainalysis both released major reports in early 2025, and they couldn’t have been more different. TRM Labs said illicit crypto activity in 2024 totaled just $10.7 billion - a 40% drop from 2023. That’s a big win. Chainalysis, meanwhile, said $40.9 billion flowed into illicit addresses last year. Which one’s right?The answer? Both. They’re measuring different things.

TRM Labs focused on fraud - scams, phishing, fake exchanges, pump-and-dump schemes. That’s what most everyday users care about. Chainalysis casts a wider net: darknet markets, ransomware payments, money laundering through mixers, even terrorist financing. Their numbers include everything that touches a known bad address. That’s why their figures keep growing - not because more crime is happening, but because they’re finding more bad actors after the fact.

Here’s the kicker: Chainalysis admitted that last year’s $24.2 billion estimate jumped to $46.1 billion once they dug deeper. That’s a 90% increase after the fact. So when they say 2024 was $40.9 billion, they expect it to hit $51 billion by next year’s report. That doesn’t mean crime spiked. It means their tools got better.

Where the Crime Is - and Where It’s Disappearing

In 2024, three blockchains handled 94% of all illicit crypto activity. TRON led with 58%. Ethereum followed at 24%. Bitcoin was third at 12%. The rest - Binance Smart Chain, Polygon, Solana - split the remaining 6%.TRON’s dominance wasn’t accidental. It’s cheap. Fast. Supports stablecoins like USDT. Perfect for scammers moving cash fast before anyone notices. But something changed in August 2024. TRON, Tether, and TRM Labs formed the T3 Financial Crime Unit - a real-time partnership between a blockchain, a stablecoin issuer, and a blockchain intelligence firm.

Within six months, they froze over $130 million in stolen funds. They blocked $6 billion in illicit volume on TRON alone. That’s a 50% drop in one platform’s criminal traffic. And here’s the most powerful part: 20% of the blocked USDT on TRON was reissued to victims or government accounts. That’s not just blocking crime - that’s reversing it.

Meanwhile, Bitcoin’s share of illicit activity stayed steady. Why? Because Bitcoin is harder to move anonymously. Every transaction is public. Every address leaves a trail. Criminals still use it, but they’re slower. More careful. And getting caught more often.

Regulation on Paper vs. Regulation in Practice

The Financial Action Task Force (FATF) says 91% of major jurisdictions have AML/CFT rules for crypto. 84% claim to enforce the Travel Rule - the rule that requires exchanges to share sender and receiver info on transactions over $1,000. Sounds good, right?PwC’s 2025 report says otherwise. Seventy-five percent of countries are still only partially compliant. Nearly 30% haven’t even implemented the Travel Rule. That’s not a technical problem. It’s a political one. Some governments don’t want to regulate crypto. Others lack the tools. A few are still trying to figure out how to track crypto without hurting innovation.

And it shows. In 2024, over 60% of the 24 major jurisdictions analyzed by TRM Labs introduced new crypto rules. But enforcement? That’s another story. The U.S. Department of Justice charged 17 people in Massachusetts in October 2024 for using bots to manipulate meme coins. That’s a real case. A real arrest. But how many others slipped through? We don’t know. Because most countries don’t publish their enforcement data.

Crypto Fines vs. Traditional Finance Fines

The crypto industry has paid out $13.5 billion in fines, penalties, and losses from hacks and fraud since 2020. That sounds like a lot - until you compare it to traditional finance.Bank of America and JPMorgan Chase alone have paid over $97 billion in fines over the same period. The entire financial sector? Over $300 billion. For mortgage fraud. For laundering money for dictators. For rigging interest rates.

So why does crypto get all the headlines? Because it’s new. Because it’s digital. Because it’s easier to panic about something you don’t understand.

The real pattern in crypto enforcement? High frequency, low dollar. Regulators are hitting exchanges and DeFi platforms with compliance notices, license revocations, and audit demands - not massive fines. They’re trying to build guardrails, not burn down the house.

What’s Next in 2025?

The first half of 2025 already saw $1.93 billion stolen in crypto-related crimes - according to Kroll’s Cyber Threat Intelligence team. That’s more than the entire year of 2023. So while fraud is declining in some areas, the attacks are getting smarter. Ransomware gangs are now using NFTs to launder money. Scammers are creating fake DeFi protocols that look like real ones. Even stablecoins are being abused - not just on TRON, but on other chains too.Regulators are adapting. By Q3 2025, 68% of global regulatory bodies plan to issue specific rules for stablecoins, DeFi, and NFTs. That’s huge. For years, these areas were the wild west. Now they’re being mapped.

The biggest shift? Cross-border cooperation. The T3 FCU model is being copied. The U.S., EU, Singapore, and South Korea are starting to share blockchain intelligence in real time. That means stolen crypto won’t just vanish into a foreign chain - it’ll be tracked, flagged, and frozen faster.

And the user base? It’s exploding. Over 560 million people used crypto in 2024. By the end of 2025, that number will hit 950 million. More users means more targets. But it also means more eyes. More reports. More pressure on bad actors.

The Real Story

Crypto enforcement isn’t about whether crime is up or down. It’s about whether we’re getting better at stopping it.The numbers show progress. TRON’s illicit volume dropped by half in six months. The U.S. is charging people for bot-driven market manipulation. The EU is preparing to enforce the Travel Rule across all exchanges. The T3 FCU proved that when blockchain companies, stablecoin issuers, and law enforcement work together, they can freeze billions.

But it’s not over. Scammers are adapting. Regulations are uneven. And the tech moves faster than the laws.

What matters now isn’t the headline number. It’s whether the next time someone gets scammed, the money can be traced - and returned. Whether the next ransomware attack gets blocked before it hits the blockchain. Whether the next $100 million theft is stopped before it even starts.

That’s the real metric. And in 2025, we’re starting to win.

Why do crypto crime reports from TRM Labs and Chainalysis differ so much?

TRM Labs tracks only fraud-related activity - scams, phishing, fake platforms. Chainalysis includes everything: ransomware, darknet markets, money laundering, and sanctioned transfers. TRM’s numbers are narrower but more relevant to everyday users. Chainalysis’s are broader and grow over time as they identify more illicit addresses. Both are accurate - they’re just measuring different things.

Is crypto more dangerous than traditional finance?

No. Crypto has paid $13.5 billion in fines and losses since 2020. Traditional finance has paid over $300 billion in the same period - for mortgage fraud, sanctions violations, and interest rate manipulation. Crypto gets more attention because it’s new and digital. But in terms of scale and impact, traditional finance still causes far more harm.

Why is TRON the most used blockchain for crime?

TRON is cheap, fast, and supports USDT - the most widely used stablecoin. Criminals use it to move money quickly before anyone notices. Transaction fees are pennies. Confirmation times are under 3 seconds. That’s ideal for scams. But after the August 2024 launch of the T3 Financial Crime Unit, TRON’s illicit volume dropped by 50% in six months - proof that targeted enforcement works.

What’s the Travel Rule, and why does it matter?

The Travel Rule requires crypto exchanges to share sender and receiver information for transactions over $1,000. It’s the crypto equivalent of bank wire reporting. Without it, criminals can move money across borders anonymously. Despite being recommended by the FATF since 2019, nearly 30% of countries still haven’t enforced it - creating dangerous gaps in global tracking.

Are crypto regulations getting stricter or more relaxed?

They’re getting smarter. Instead of banning crypto, most countries are building rules around it. In 2024, over 60% of major jurisdictions introduced new crypto policies. The focus is shifting from punishing users to regulating exchanges, stablecoins, and DeFi protocols. Enforcement is becoming more targeted, technical, and collaborative - especially through public-private partnerships like the T3 FCU.

What’s the biggest threat to crypto enforcement in 2025?

The biggest threat isn’t crime - it’s fragmentation. With over 190 countries, each with different rules, criminals exploit gaps between jurisdictions. A scammer in Brazil can send funds to a wallet in Vietnam, then to a DeFi protocol in the Cayman Islands - all before any authority catches up. Real progress will come only when countries start sharing data in real time, not just signing agreements on paper.

Eddy Lust

November 26, 2025 AT 09:09Man, I just read this whole thing and I’m sitting here like… we’re treating crypto like it’s some wild beast when it’s just code. People get scared of what they don’t understand. I mean, you think banks are clean? Nah. They just have better PR and bigger lawyers. Crypto’s messy, yeah-but at least it’s honest about being messy. 🤷♂️

SARE Homes

November 26, 2025 AT 17:44TRM Labs? Chainalysis? Please. Both are funded by the same VC firms that own the exchanges. This is all theater. They want you to believe the system is ‘fixing itself’ so you keep investing while they quietly siphon the liquidity. The ‘50% drop’ on TRON? That’s because they scrubbed the addresses they couldn’t trace. It’s not enforcement-it’s whitewashing. And don’t even get me started on ‘T3 FCU’-a PR stunt with a fancy name!

Ben Costlee

November 28, 2025 AT 03:08I’ve been in this space since 2017. I’ve seen panic, I’ve seen hype, I’ve seen crashes. But this? This is the first time I’ve seen real collaboration-blockchain teams, stablecoin issuers, law enforcement-actually talking to each other. The T3 FCU isn’t perfect, but it’s a start. We don’t need to ban crypto. We need to build bridges. And for once, someone’s building them.

SHASHI SHEKHAR

November 28, 2025 AT 05:19Let’s break this down properly, because the data is actually fascinating if you look beyond the headlines. TRON dominates illicit flows because of its low fee and high throughput-ideal for micro-fraud operations like phishing bots and fake NFT mints. But here’s the kicker: USDT on TRON is now being tracked in real-time via on-chain analytics + KYC-linked wallet tagging. That’s why the drop happened. It’s not magic-it’s data fusion. And yes, 20% of frozen funds going back to victims? That’s revolutionary. Most traditional systems can’t even return stolen cash. We’re talking about a system that’s literally healing itself. 🤯

fanny adam

November 29, 2025 AT 03:18Who controls the blacklists? Who defines ‘illicit address’? Chainalysis doesn’t just track crime-they shape it. Their database is proprietary. Their algorithms are secret. If they flag an address, you’re blacklisted forever, no appeal. And yet, they’re the ones regulators trust. That’s not oversight. That’s corporate sovereignty masquerading as law enforcement. This isn’t progress-it’s a surveillance oligopoly.

Sam Daily

November 30, 2025 AT 23:48Bro. The fact that we’re even having this conversation means we’re winning. Five years ago, no one cared. Now governments are building teams. Exchanges are cooperating. Victims are getting money back. Yeah, it’s messy. Yeah, it’s slow. But we’re moving. And if you’re still scared of crypto because of headlines? You’re looking at the wrong thing. Look at the actions-not the noise.

George Kakosouris

December 2, 2025 AT 18:07Let’s be real: the $13.5B in crypto losses? That’s chump change compared to the $300B in traditional finance. But here’s the jargon-heavy truth-crypto’s risk profile is asymmetric. Small volume, high volatility, low institutional guardrails. That’s why regulators go hard on exchanges: they’re the choke point. You don’t arrest every scammer-you shut down the ATM they’re using. That’s not overreach. That’s risk management. And until we get global Travel Rule enforcement, we’re just playing whack-a-mole with blockchain addresses.

imoleayo adebiyi

December 2, 2025 AT 23:25As someone from Nigeria, I’ve seen crypto save lives. People use it to send money home when banks freeze accounts. But I’ve also seen friends get scammed on fake exchanges. The truth is in the middle. We need better tools-not bans. The T3 FCU model? That’s the way. Local knowledge + global tech. No ideology. Just results. I hope more African countries join these partnerships. We’re not the problem-we’re part of the solution.

stephen bullard

December 3, 2025 AT 07:55It’s not about whether crime is up or down. It’s about whether justice can catch up. That’s the real metric. And for the first time, I’m seeing it happen-not in courtrooms, but in code. When a scammer sends $2M to a TRON wallet and it’s frozen within hours? That’s not regulation. That’s evolution. We’re not policing a currency. We’re policing a new kind of human interaction. And honestly? I’m proud of how far we’ve come.

Felicia Sue Lynn

December 4, 2025 AT 04:08Perhaps the most profound insight here is that we’re no longer asking whether crypto is good or bad-but whether we, as a global society, are capable of governing something that transcends borders, currencies, and centuries of legal tradition. The answer, slowly, quietly, is emerging: yes. Not because of laws, but because of collaboration. And that, more than any statistic, is the story worth telling.