Blockfinex Crypto Exchange Review: What You Need to Know Before Trading

Jun, 29 2025

Jun, 29 2025

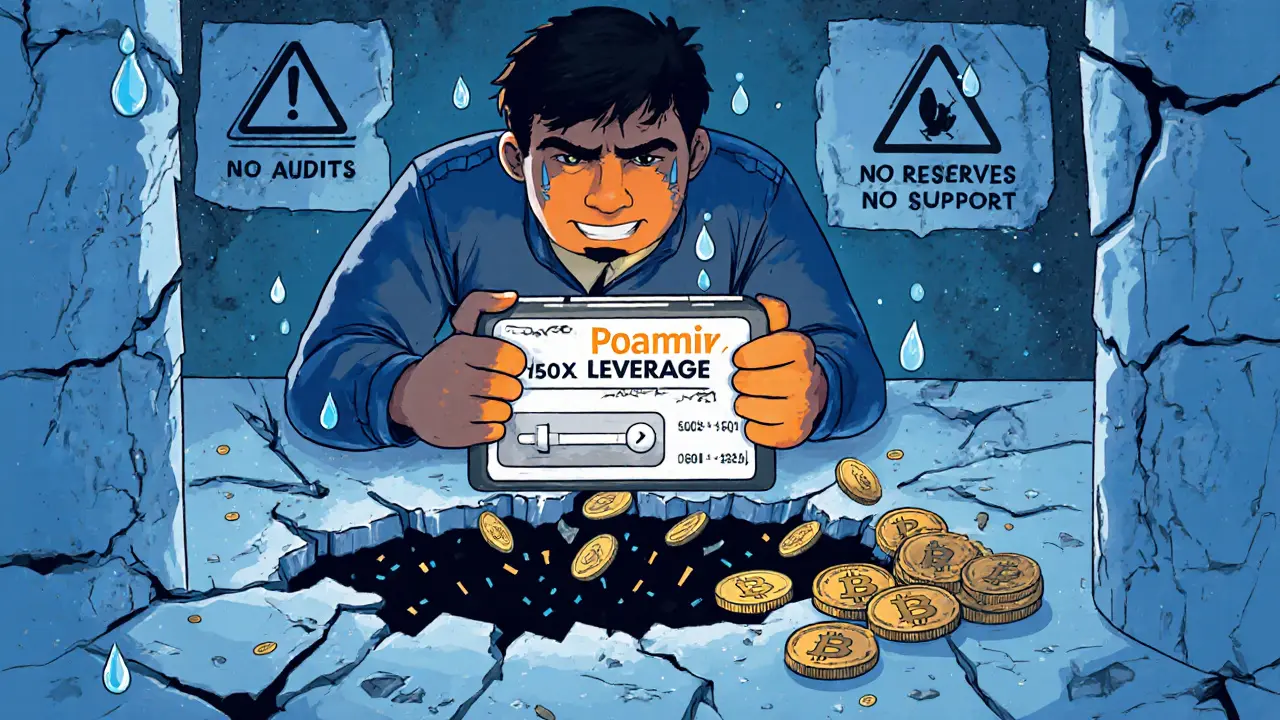

Leverage Risk Calculator

Calculate Your Risk

This tool demonstrates how leverage magnifies both gains and losses in crypto trading. Blockfinex claims up to 150x leverage, but high leverage is extremely dangerous for most traders.

Warning: Leverage above 100x is extremely risky and can lead to instant liquidation with minimal price movement.

Blockfinex isn’t one of those crypto exchanges you hear about on Reddit or see trending on Twitter. You won’t find it in the top 10 lists of most crypto guides. But if you’ve stumbled across it while searching for high-leverage trading or a platform with 300+ coins, you’re probably wondering: Is Blockfinex safe? Is it even worth trying?

What Is Blockfinex, Really?

Blockfinex launched in 2020 and operates out of Seychelles, Barbados, and the UAE. It’s not connected to Bitfinex, despite the similar name. Bitfinex is a well-known, older exchange with a history of hacks and regulatory trouble. Blockfinex is a separate company under Dan Group Holdings Ltd. It markets itself as a platform built for “a more inclusive financial system,” but that’s marketing speak. What does it actually offer? It supports over 300 cryptocurrencies - Bitcoin, Ethereum, Tron, Avalanche, and a bunch of smaller altcoins. You can trade them on spot markets or use leverage on derivatives. The mobile apps for iOS and Android are available, so you can trade on the go. That’s standard. But here’s where things get fuzzy.Transparency Issues: The Big Red Flag

CoinMarketCap lists Blockfinex as an “Untracked Listing.” That’s not a minor detail - it’s a major warning. It means CoinMarketCap can’t verify its trading volume. No one knows how much is actually being traded. Is it $10 million a day? $100 million? Or is it just bots and fake activity? Compare that to Binance, which reports $864 million in 24-hour volume - and that number is verified. Coinbase, Kraken, Bybit - all have tracked volumes. Blockfinex doesn’t. That’s a red flag for serious traders. If you can’t trust the volume, you can’t trust the liquidity. And if liquidity is thin, your orders get slippage, delays, or even fail to fill.Fees and Leverage: The Allure

Blockfinex claims to offer “low fees and competitive execution.” But here’s the problem: they don’t publish their fee schedule anywhere. No official page. No FAQ. No API docs. You have to guess. Based on comparisons with BloFin - a platform that’s nearly identical in name, features, and coin count - Blockfinex might charge around 0.1% for spot trades and 0.02%-0.06% for futures. That’s not bad. It’s in line with Binance. But without official confirmation, you’re taking a risk. The real draw? Leverage. BloFin offers up to 150x leverage. If Blockfinex is the same, that’s a huge temptation. 150x means you can control $150,000 with $1,000. Sounds powerful. But here’s the catch: high leverage isn’t a tool. It’s a trap for beginners. One bad move, and you’re wiped out. Even experienced traders get liquidated at 100x+. You need discipline, strategy, and a solid risk plan. Most people don’t have that.

Security: No Audits, No Proof of Reserves

Blockfinex says its infrastructure is “highly secure and robust.” That’s nice. But words don’t protect your crypto. There’s no public proof of reserves. No third-party audits. No cold storage reports. No security certifications. Nothing. Not even a blog post about a recent security update. Compare that to Coinbase, which publishes monthly attestation reports from independent firms. Or Kraken, which has been audited for years. Blockfinex gives you zero visibility. That’s not just risky - it’s irresponsible. If the exchange gets hacked, you won’t get your funds back. There’s no insurance fund. No legal recourse. You’re on your own.Customer Support and Learning Resources

You won’t find tutorials, help centers, or detailed guides on Blockfinex’s website. No YouTube videos from the team. No Reddit AMAs. No community forums. If you’re new to crypto, you’re stuck. No one’s there to explain how to set a stop-loss or what a funding rate is. And customer support? No one’s talking about it. No Trustpilot reviews. No Reddit threads asking, “Did Blockfinex reply to your ticket?” That silence speaks volumes. If users were happy, they’d be talking. If they were angry, they’d be screaming. The fact that no one’s saying anything suggests either very few people use it - or they’ve all left quietly after losing money.Who Is Blockfinex For?

Let’s be clear: Blockfinex isn’t for most people. If you’re a beginner, avoid it. You need education, security, and support - none of which Blockfinex provides. If you’re an institutional investor or someone who cares about compliance, skip it. No regulatory licenses. No KYC/AML transparency. You’re playing in the wild west. If you’re a high-risk, high-reward trader who understands leverage, knows how to manage volatility, and is okay with zero transparency - then maybe you’ll consider it. But even then, you’re trading on faith, not facts.

Alternatives That Actually Deliver

There are better options out there - platforms that prove they’re trustworthy.- Binance: Highest volume, 1,700+ trading pairs, verified data, strong security, and educational resources. Fees start at 0.1%.

- Bybit: Excellent for derivatives. 200x leverage, 0.0055% taker fees, and transparent liquidity metrics.

- Coinbase: Best for beginners and U.S. users. Fully regulated, insured custodial wallets, simple UI.

- Kraken: Trusted for security. Audited regularly, supports staking, and has strong compliance.

The Bottom Line

Blockfinex feels like a ghost exchange. It’s there on CoinMarketCap. It has an app. It claims to offer leverage and low fees. But there’s no proof. No transparency. No community. No reputation. In crypto, the safest choice isn’t always the flashiest. It’s the one that shows you its work. Blockfinex doesn’t. And in a space full of scams, that’s the biggest red flag of all.If you’re tempted by high leverage or a long list of coins, ask yourself: Is the risk worth it? Or are you just chasing a gamble dressed up as an exchange?

Is Blockfinex a scam?

Blockfinex isn’t officially labeled a scam, but it has all the warning signs. No verified trading volume, no security audits, no regulatory licenses, and zero user reviews. These aren’t just gaps - they’re red flags. Many exchanges that disappear after a few years started the same way. Treat it as high-risk until proven otherwise.

Does Blockfinex have a mobile app?

Yes, Blockfinex offers mobile apps for both iOS and Android. The apps are functional for trading, but they lack educational content, tutorials, or in-app support. If you’re looking for a polished, user-friendly experience, you’ll find better apps on Coinbase or Binance.

What are Blockfinex’s trading fees?

Blockfinex doesn’t publish its fee structure publicly. Based on comparisons with BloFin - a nearly identical platform - fees are likely around 0.1% for spot trades and 0.02%-0.06% for futures. But without official confirmation, you’re guessing. Always assume the worst-case scenario when fees are hidden.

Can I trust Blockfinex with my crypto?

No, not if you value security. Blockfinex provides no proof of reserves, no third-party audits, and no insurance for user funds. If the exchange is compromised, you have no recourse. Even small exchanges like Kraken and Bybit publish security reports. Blockfinex doesn’t - and that’s a dealbreaker for anyone serious about protecting their assets.

Is Blockfinex better than Bitfinex?

No. Bitfinex has a long history - including major hacks and regulatory fines - but at least it’s transparent about its operations. It has verified volume, a known user base, and public audits. Blockfinex, on the other hand, has none of that. It’s newer, smaller, and far less accountable. If you’re choosing between the two, Bitfinex is the lesser of two evils.

Why isn’t Blockfinex on CoinGecko?

CoinGecko has stricter listing standards than CoinMarketCap. Blockfinex doesn’t meet CoinGecko’s requirements for volume verification, transparency, or operational history. Its absence from CoinGecko reinforces the idea that it’s not considered a reliable or active exchange by industry data standards.

Should I use Blockfinex for long-term investing?

Absolutely not. Long-term investing requires security, stability, and reliability. Blockfinex offers none of that. Use a regulated exchange like Coinbase or Kraken to hold Bitcoin or Ethereum for years. Blockfinex is designed for speculative, short-term trading - and even then, it’s risky.

Are there any real user reviews of Blockfinex?

There are virtually no credible user reviews on Trustpilot, Reddit, or crypto forums. No complaints. No praise. No screenshots of trades. This silence is unusual. Even obscure exchanges have at least a few users speaking up. The lack of feedback suggests either extremely low usage or a user base that left after losing money - and didn’t bother to warn others.

Joel Christian

November 26, 2025 AT 20:11so i signed up for blockfinex last week bc i saw 150x leverage and thought "this is my ticket"... then i lost 800 bucks in 20 min because my stop loss didnt trigger?? no one responds to support tickets and the app just says "loading" for 5 mins then crashes. wtf is this place??

jeff aza

November 27, 2025 AT 01:26Blockfinex is a textbook example of a shell exchange-no proof of reserves, no audit trail, no KYC transparency, and a fee schedule that’s buried under a layer of corporate obfuscation. The absence of CoinGecko listing alone should be a non-negotiable red flag for any serious trader. The 300+ coin list? That’s not diversity-it’s a graveyard of memecoins pumped by bots. And don’t get me started on the leverage: 150x isn’t trading, it’s financial Russian roulette with a loaded chamber and no trigger guard. If you’re not using a cold wallet and a dedicated air-gapped device to monitor this, you’re already losing.

Vijay Kumar

November 28, 2025 AT 19:31You think this is bad? Wait till you see the real scam: people who think they’re smart because they use leverage. Crypto isn’t a casino. It’s a mirror. You don’t find wealth-you find yourself. Blockfinex? Just a mirror with broken glass.

Ian Esche

November 29, 2025 AT 00:27Why are we even talking about this? This is a foreign shell company with no ties to the U.S. financial system. If you’re not using Binance, Coinbase, or Kraken, you’re not trading-you’re gambling with your American savings. This isn’t freedom, it’s financial anarchy. And you wonder why the U.S. is falling behind in crypto innovation?

Felicia Sue Lynn

November 29, 2025 AT 18:02It’s fascinating how we equate transparency with trustworthiness in financial systems, yet so many are willing to surrender their assets to platforms that operate in the shadows. Blockfinex doesn’t merely lack documentation-it embodies a culture of opacity that contradicts the very ethos of decentralized finance. Perhaps the real question isn’t whether it’s safe, but whether we, as a community, are willing to demand more from the tools we choose to entrust with our futures.

Christina Oneviane

December 1, 2025 AT 10:26Oh wow, Blockfinex? That’s the one that looks like a PowerPoint slide from a 2017 crypto bro’s basement, right? "Inclusive financial system" my ass. They probably got their UI designer from a Fiverr gig titled "Make it look like Binance but cheaper."

fanny adam

December 3, 2025 AT 02:35Blockfinex is a honeypot. Every element-the name, the lack of audits, the absence of user reviews, the CoinMarketCap untracked status-is engineered to attract speculative capital from the uninformed. This is not an exchange; it is a front for a wash-trading operation designed to siphon funds into offshore wallets before vanishing. The silence from users isn't indifference-it's the aftermath of mass liquidation. History repeats: BitConnect, OneCoin, PlusToken-all began as "innovative platforms" with no transparency. This is the same script. The only difference is the logo.