Crypto Exchanges to Avoid if You Are Russian: High-Risk Platforms and Legal Consequences

Mar, 11 2025

Mar, 11 2025

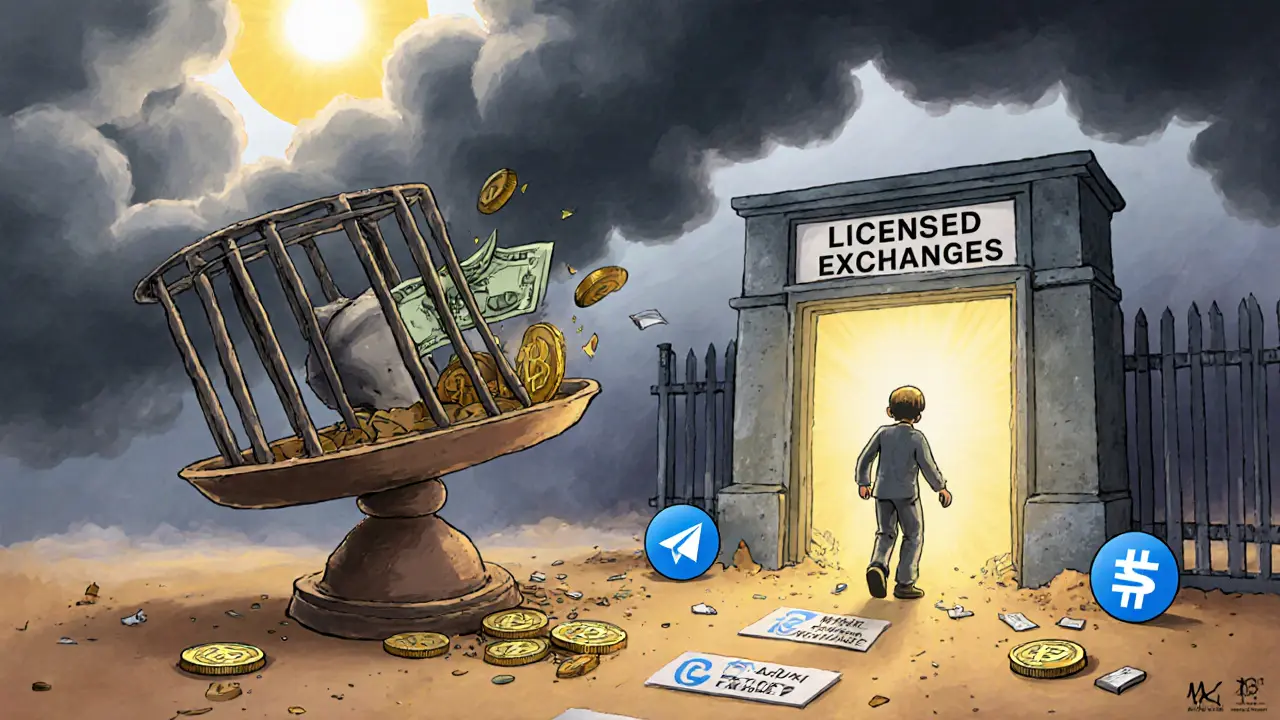

If you're in Russia and thinking about using a crypto exchange, stop. Not all exchanges are created equal-and some could land you in serious legal trouble, cost you your savings, or even trigger a police raid. The landscape has changed drastically since early 2024. What once seemed like a simple way to send money abroad or trade Bitcoin is now a minefield of sanctioned platforms, frozen accounts, and criminal investigations.

Why This Matters Right Now

Russia doesn’t ban owning cryptocurrency. You can hold Bitcoin, Ethereum, or USDT in your wallet without breaking the law. But using crypto for payments inside Russia? Illegal. And using certain exchanges to move money out of the country? That’s where things get dangerous. In late 2024, Russian security services launched coordinated raids across more than a dozen regions. They seized over $10 million in cash, 100 million rubles, and 200,000 euros-not from drug dealers or smugglers, but from people running crypto exchanges. The target? Platforms that helped users bypass Russia’s capital controls and launder money through offshore accounts. The Bank of Russia has made it clear: if an exchange isn’t licensed under Russia’s experimental legal regime for international trade, it’s high-risk. And if it’s linked to Garantex, Exved, or Grinex? It’s not just risky-it’s a legal time bomb.Exchanges to Avoid at All Costs

These are the platforms you should never touch if you’re in Russia:- Garantex - Once the largest Russian crypto exchange, Garantex was officially sanctioned by the U.S. Treasury in April 2022 for enabling ransomware payments, including Hive. By March 2025, the U.S. Department of Justice unsealed indictments showing Garantex processed over $500 million in illicit transactions. It was shut down, but its operators quickly relaunched under new names.

- Exved - Created by the same team behind Garantex, Exved operated as a payment processor disguised as a tool for importers and exporters. It used Alfa-Bank accounts to convert rubles into USDT, then sent funds overseas. Transparency International Russia found Exved processed over 2 billion rubles monthly through this scheme. Russian authorities raided its offices in the Moscow International Business Center in October 2024.

- Grinex - The direct successor to Garantex, Grinex inherited its infrastructure, staff, and customers. Users reported sudden account freezes, no customer support, and lost funds after depositing rubles. Trustpilot reviews average just 1.2 out of 5 stars. Over 278 documented cases on RuTracker show users losing an average of 850,000 rubles each.

- MKAN Coin (Telegram-based) - This isn’t even a real exchange. It’s a Telegram bot that lets users trade crypto with just a phone number. No ID, no verification, no protection. It’s a classic “dropper” scheme: users send rubles to a middleman, who converts them to USDT and sends it abroad. The Bank of Russia flagged this model as a top money laundering tool in its 2024 AML guidelines.

These platforms share one thing: they avoid Russian financial oversight. They don’t report transactions to Rosfinmonitoring. They don’t verify identities properly. And they route money through shell companies in places like Hong Kong, Georgia, or the UAE-making it nearly impossible to trace funds back to the user… until Russian police show up at your door.

How These Exchanges Work (And Why They’re So Dangerous)

Here’s the typical flow:- You deposit rubles into a bank account linked to a Hong Kong-based company like Feilian Company Limited.

- That company converts your rubles into USDT or Bitcoin using Alfa-Bank or another Russian bank.

- The crypto is sent to an offshore wallet, then cashed out in euros, dollars, or stablecoins abroad.

This looks like a simple workaround for capital controls. But here’s the catch: Russian law considers this an illegal currency transaction under Article 193.1 of the Criminal Code. Even if you’re just sending $500 to pay for a service overseas, you can be charged with a criminal offense.

And the penalties? Up to 7 years in prison for large-scale violations. Fines of up to 1 million rubles if new draft laws pass. And no, the exchange won’t help you. They disappear. Your money? Gone. Your account? Frozen. Your phone? Likely tapped.

What Happens When You Get Caught

Real people are already paying the price. On Dvach, a user named ‘CryptoPatriot_88’ lost 1.2 million rubles when Grinex froze all accounts in March 2025. He messaged support daily for three weeks. No reply. On Reddit’s r/RussianCrypto, 87% of 1,243 respondents said they’d never use an unlicensed exchange again after the 2025 crackdowns. But it’s not just about losing money. Police have started targeting users directly. In October 2025, Interfax reported the seizure of 37 exchange servers in Moscow-not just from operators, but from private homes. Russian authorities now use bank transaction data to identify frequent users of sanctioned platforms. If you regularly send rubles to a Hong Kong-linked account for crypto conversion, you’re on a watchlist. The Ministry of Finance confirmed in September 2025: users of unlicensed exchanges have no legal recourse if funds are lost. No refunds. No complaints. No lawsuits. You’re on your own.What About Licensed Exchanges?

There are a few exchanges operating under Russia’s experimental legal regime. These are the only ones that report to Rosfinmonitoring and comply with AML rules. But they’re not for everyone. To use them, you need to be an “especially qualified investor”-meaning you must have at least 6 million rubles ($65,000) in assets. Most are used by businesses engaged in sanctioned international trade, not regular people. If you’re an individual trader, your options are extremely limited. The Bank of Russia doesn’t allow ordinary citizens to use these platforms for personal trading. And even if you could, the verification process takes 2-3 days-not 5 minutes like the banned exchanges.Red Flags to Watch For

If an exchange does any of these, walk away:- Onboarding with just a phone number

- Operating through Telegram or WhatsApp

- Promising “no paperwork” or “sanction-proof transfers”

- Accepting rubles directly from Russian banks

- No website, only a Telegram bot or dark web link

- Has no public team, no legal address, no contact info

These aren’t just signs of poor service. They’re signs you’re dealing with a sanctioned, criminal operation.

The Bigger Picture: Why This Is Getting Worse

Russia’s crackdown isn’t slowing down. In fact, it’s accelerating. After the March 2025 Garantex takedown, trading volume on sanctioned platforms dropped 78%. Overall crypto volume in Russia fell 35% in early 2025. By Q2 2026, analysts predict 90% of users will abandon these platforms due to enforcement pressure. The U.S. Department of State is offering up to $5 million for information leading to the arrest of Garantex’s founders. Rosfinmonitoring now shares crypto transaction data with international agencies like FATF. Russian banks are required to flag suspicious transfers to offshore crypto companies. The message is clear: if you’re using an unlicensed exchange, you’re not just breaking rules-you’re playing with fire.What Should You Do Instead?

If you need to move money internationally, use legal channels:- Bank wire transfers through licensed institutions

- Official foreign currency exchange services

- International payment platforms like Wise or PayPal (where available)

Yes, they’re slower. Yes, they cost more. But they’re safe. And if you’re trying to protect your money, your freedom, and your future-those are the only costs that matter.

There’s no clever workaround. No hidden backdoor. No “safe” unlicensed exchange. The ones that looked fast and easy are now the ones that got people arrested.

Final Warning

Crypto isn’t the problem. The problem is using platforms that are designed to evade Russian law. The same tools that let you trade Bitcoin can also get you a criminal record. And once you’re flagged, there’s no undo button. The safest crypto strategy for Russian citizens right now? Don’t use any exchange that isn’t licensed by the Bank of Russia-and even then, only if you meet the strict investor requirements. Everything else is a gamble with your freedom.Can I still own cryptocurrency in Russia?

Yes, owning cryptocurrency is legal in Russia under Federal Law No. 114-FZ. You can buy, hold, and store Bitcoin, Ethereum, or USDT in your personal wallet without breaking the law. The issue isn’t ownership-it’s how you use it. Using crypto for payments inside Russia is banned, and using unlicensed exchanges to move money abroad can lead to criminal charges.

What happens if I used Garantex or Exved and lost my money?

Unfortunately, you have no legal recourse. The Russian Ministry of Finance confirmed in September 2025 that users of unlicensed exchanges have no protection under the law. The exchanges don’t have licenses, so they’re not required to refund you, and courts won’t intervene. Your only option is to report the loss to police-but even then, recovery is extremely rare. Most users never get their funds back.

Are there any safe crypto exchanges for Russians right now?

There are only a handful of exchanges operating under Russia’s experimental legal regime, and they’re designed for corporate clients with at least 6 million rubles in assets. These platforms report transactions to Rosfinmonitoring and comply with strict AML rules. For individual users, there are no truly safe exchanges for personal trading. Even licensed platforms restrict access to qualified investors. For most people, the safest path is to avoid crypto exchanges entirely.

Can Russian police track me if I use a banned exchange?

Yes. Russian authorities now monitor bank transactions linked to known offshore crypto companies. If you regularly send rubles to a Hong Kong-based firm like Feilian Company Limited, your bank will flag it. Rosfinmonitoring shares this data with law enforcement. Police raids in 2024-2025 targeted not just exchange operators, but individual users whose transaction patterns matched known money laundering patterns. Even small transfers of 50,000 rubles have led to investigations.

Is it safe to use Telegram bots like MKAN Coin?

No. Telegram-based crypto bots like MKAN Coin are among the most dangerous tools available. They require no ID, no verification, and no paperwork-exactly what money launderers want. The Bank of Russia explicitly identified these bots as high-risk in its 2024 AML guidelines. Users are often scammed, their funds stolen, or they’re later investigated for illegal currency transactions. These aren’t exchanges-they’re digital traps.

Will Russian laws change to allow more crypto use?

The Ministry of Finance proposed easing licensing rules in October 2025-but only for exchanges serving sanctioned international trade, not regular users. A draft bill (No. 45876-8) is currently under review in the State Duma that would make using banned exchanges a criminal offense, with fines up to 1 million rubles for first-time offenders. The trend is clear: stricter rules, not looser ones. Don’t expect any legal relaxation for individual traders.

SARE Homes

November 27, 2025 AT 04:46This is why I told my cousin in Moscow to stop playing with crypto like it's a video game! You think you're being clever by using Telegram bots? You're just handing your life savings to criminals who laugh all the way to Dubai. Garantex? Exved? Those aren't exchanges-they're legal landmines with fake customer service chatbots. And now the Russian police are literally knocking on doors? Yeah, that's what happens when you ignore the warning signs. You're not a tech genius-you're a pawn in a money laundering scheme. Stop being dumb.

Grace Zelda

November 28, 2025 AT 05:32I get why people turn to these platforms-capital controls are brutal, and banks are slow as molasses. But this post isn't wrong. I've seen too many Reddit threads from Russians who lost everything because they trusted a Telegram bot with ‘no KYC’ written in glowing neon. It's not about freedom-it's about survival. The fact that the Bank of Russia flagged MKAN Coin as a top AML risk? That's not paranoia. That's data. And yeah, even if you're just sending $500 to pay for a subscription, you're still on the radar. The system doesn't care if you're ‘innocent’-it cares about patterns. I wish more people understood that before it's too late.

Sam Daily

November 29, 2025 AT 07:06Look, I'm not here to scare anyone-but if you're reading this and you're still using Grinex or some sketchy Telegram bot? STOP. RIGHT. NOW. 🚨 I've worked with fintech compliance teams in the U.S. and Europe, and the way Russian authorities are tracking these transactions? It's next-level. They're not just watching bank transfers-they're using AI to flag patterns. One guy sent 50k rubles every Tuesday to Feilian Co. Ltd.? Boom. Flagged. That's not conspiracy theory-that's machine learning. And when they show up at your door? No warning. No second chance. Just a warrant and a seizure notice. Your crypto isn't safe. Your phone isn't safe. Your life isn't safe. Use Wise. Use PayPal. Even if it costs more-it's cheaper than prison. 💪

Rachel Thomas

November 29, 2025 AT 16:11Sierra Myers

November 30, 2025 AT 21:06