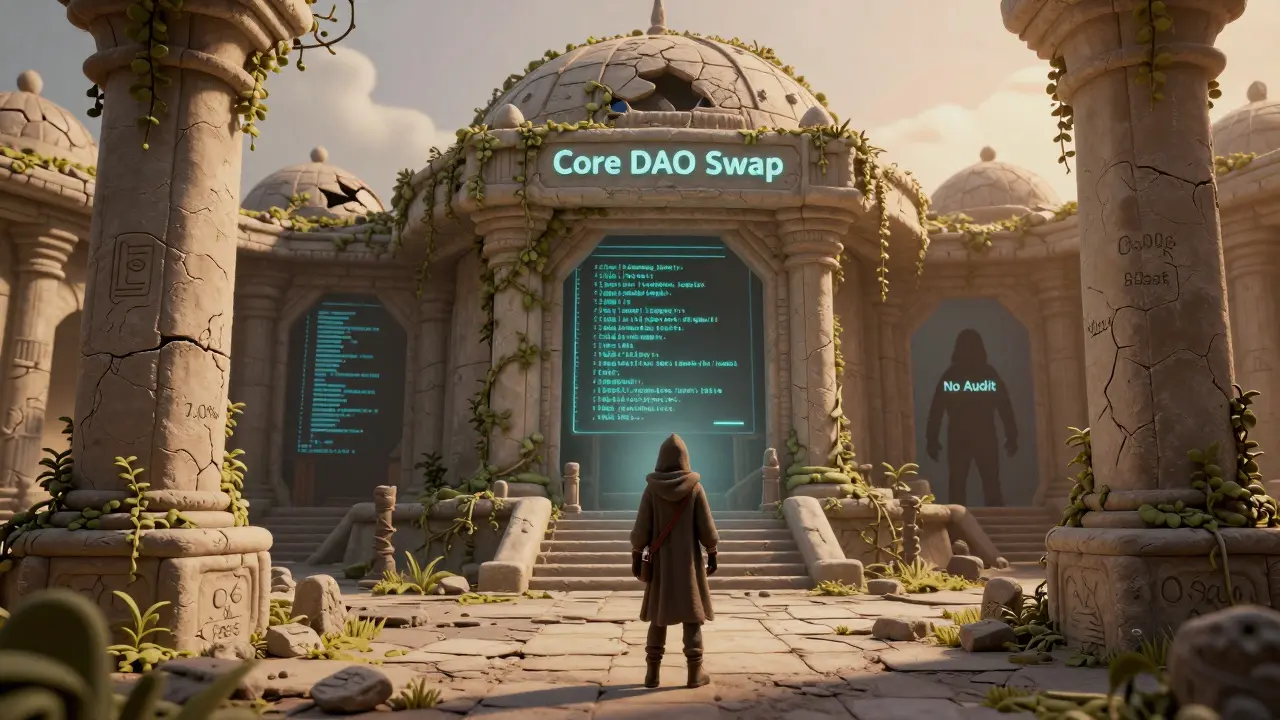

DAO Swap Crypto Exchange Review: Is Core Dao Swap Worth Trying in 2026?

Feb, 9 2026

Feb, 9 2026

When you hear "DAO Swap," you might think of a slick, decentralized exchange with deep liquidity and a thriving community. But the reality is more complicated. As of 2026, the platform most commonly associated with that name - Core Dao Swap - is barely visible in the crowded crypto exchange space. It’s not a ghost, but it’s close. No user reviews. No traffic. No regulatory oversight. And yet, it promises something rare: zero trading fees for every trade, maker or taker.

What Is Core Dao Swap?

Core Dao Swap is tied to the Core DAO blockchain, a project that tries to merge Bitcoin’s security with Ethereum’s smart contract power. It uses something called "Satoshi Plus" consensus - a mix of Proof-of-Work and Proof-of-Stake - to keep things secure. The exchange itself is just one part of that ecosystem. It’s not built on Ethereum or Binance Chain. It runs on its own network, which means you can’t just connect your MetaMask and start swapping.On paper, the idea sounds smart. Trade tokens without paying fees. No hidden costs. No maker-taker spreads. That’s not just rare - it’s almost unheard of. Most DEXs like Uniswap charge 0.3% per trade. Even centralized giants like Binance charge 0.1% for spot trades. Core Dao Swap says 0.00%. But here’s the catch: no one seems to be using it.

The Zero-Fee Promise - Too Good to Be True?

Let’s talk about the fees. If you’re trading on Core Dao Swap, you pay nothing. Not for buying, not for selling, not even for withdrawing. That’s not a promotion. It’s the standard. And while that sounds like a gift from the crypto gods, it raises red flags.Exchanges need to make money somehow. They cover server costs, security audits, customer support, and development. Most charge fees. Some make money from listing tokens. Others earn from staking rewards or liquidity mining. Core Dao Swap doesn’t appear to have any of those models. If they’re not charging users, how are they paying their team? Are they funded by the Core DAO treasury? Is this a long-term strategy to gain users before introducing fees? Or is it simply not sustainable?

There’s no public financial report. No whitepaper explaining their revenue model. That’s not normal. Even obscure DEXs like GhostSwap or Jumper.Exchange have clear funding paths. Core Dao Swap doesn’t. And when there’s no transparency, you’re trading on faith - not facts.

Who’s Actually Using It?

Web traffic data from 2025 shows Core Dao Swap ranks #599 out of 630 crypto exchanges in organic traffic. That’s worse than 98% of all exchanges. Worse than most new projects that barely launch. The numbers are even stranger: 0% bounce rate, 0.00 pages per visit, 00:00:00 average visit duration. These aren’t real user behaviors. They’re data glitches - or worse, signs that no one is visiting at all.There are zero reviews on Trustpilot, Reddit, or CoinGecko. No YouTube tutorials. No Twitter threads from traders sharing wins or losses. No Discord community with active chat. If a platform has no users, it has no liquidity. And if it has no liquidity, your trades won’t fill. Or they’ll slippage 20%, 30%, even 50% before execution. You think you’re getting a free trade. You might end up losing money because the market is too thin.

Security and Regulation - A Big Risk

Core Dao Swap is not regulated by any government body. Not in the U.S. Not in the EU. Not in the UK. That means if something goes wrong - if your funds disappear, if the site gets hacked, if the team vanishes - you have no legal recourse. No ombudsman. No insurance fund. No way to file a complaint.Compare that to Crypto Dao, a UK-regulated platform with a flat 0.15% fee. If you have an issue with Crypto Dao, you can contact the Financial Conduct Authority. With Core Dao Swap? You’re on your own. And in crypto, "on your own" often means "out of luck."

There’s also no public audit report. No smart contract verification on Etherscan or a similar chain explorer. No bug bounty program. No known security team. You’re trusting code that no one has reviewed. That’s not just risky - it’s reckless.

What Tokens Can You Trade?

Here’s another problem: we don’t know what’s listed. The website doesn’t publish a full token list. No search bar. No category filters. No market cap data. If you want to swap $WIF for $PEPE, you have to hope it’s there. There’s no way to check.Compare that to Uniswap, which supports over 10,000 tokens. Or GhostSwap, which lists 1,500+ with cross-chain support. Core Dao Swap? No data. That means you can’t plan your trades. You can’t compare prices. You can’t even know if the token you want exists on the platform. That’s not a trading interface - it’s a guessing game.

How It Compares to the Competition

| Feature | Core Dao Swap | Uniswap v3 | GhostSwap | Crypto Dao |

|---|---|---|---|---|

| Trading Fees | 0.00% | 0.30% | 0.10% | 0.15% |

| Regulation | None | None | None | UK FCA |

| Supported Tokens | Unknown | 10,000+ | 1,500+ | 500+ |

| Cross-Chain | Unclear | Ethereum only | Yes | Yes |

| User Reviews | 0 | 12,000+ | 8,000+ | 1,200+ |

| Mobile App | No | Yes | Yes | Yes |

| Liquidity Depth | Very Low | High | High | Medium |

Uniswap dominates because it’s reliable. GhostSwap wins for privacy. Crypto Dao stands out because it’s legal. Core Dao Swap? It has one advantage - zero fees. But everything else? It’s behind. Or missing entirely.

Is There Any Reason to Use It?

If you’re a high-risk taker, curious about experimental chains, and willing to lose money for the sake of testing - maybe. But even then, there are better ways. You can try new DEXs on Polygon or Arbitrum. You can join testnets for upcoming projects. You don’t need to risk real funds on a platform with no users, no audits, and no transparency.The Core DAO blockchain itself has potential. Its Bitcoin-DeFi bridge could be useful. But the exchange? It’s not ready. It’s not tested. It’s not trusted. And in crypto, trust isn’t optional - it’s everything.

Final Verdict: Don’t Use It - Yet

Core Dao Swap isn’t a scam. Not yet. But it’s not a real exchange either. It’s a prototype with no users, no data, and no safety nets. The zero-fee model sounds amazing - until you realize no one else is trading. That means your trades won’t execute. Your tokens might get stuck. Your funds could vanish with no way to recover them.If you’re looking for a free exchange, try one with a track record. Uniswap has been around for years. PancakeSwap handles billions daily. Even lesser-known platforms like Jumper.Exchange have active communities and public audits.

Core Dao Swap might grow. Maybe in 2027, it’ll have liquidity, reviews, and a real team. But right now? It’s a gamble with no odds in your favor. Save your money. Wait for proof. Don’t be the first to test a platform that hasn’t proven it can even stay online.

Is Core Dao Swap regulated?

No, Core Dao Swap is not regulated by any financial authority as of 2026. It operates without oversight from the SEC, FCA, or any other government body. This means users have no legal protection if funds are lost, hacked, or frozen.

Does Core Dao Swap have a mobile app?

There is no official mobile app for Core Dao Swap. The platform is only accessible via web browser, and even then, the website has minimal traffic and functionality. Most reliable exchanges offer apps for iOS and Android - Core Dao Swap does not.

What cryptocurrencies can I trade on Core Dao Swap?

The platform does not publish a list of supported tokens. There is no search function, no market data, and no way to verify if your desired asset is available. This lack of transparency makes it impossible to plan trades or compare prices.

Why is Core Dao Swap so cheap to use?

Core Dao Swap charges 0.00% fees for all trades, which is extremely rare. However, this model lacks a clear revenue source. Most exchanges earn from listing fees, staking, or liquidity mining. Core Dao Swap has not disclosed how it covers operational costs, raising concerns about sustainability.

Is Core Dao Swap safe to use?

No, Core Dao Swap is not considered safe for real funds. There are no public smart contract audits, no security team, no bug bounty program, and zero user reviews. Without these safeguards, users risk losing funds to hacks, scams, or platform failure with no recourse.

How does Core Dao Swap compare to Uniswap?

Uniswap supports over 10,000 tokens, has billions in daily trading volume, and is used by millions. Core Dao Swap has no known trading volume, no user base, and limited functionality. While Core Dao Swap offers zero fees, Uniswap provides reliability, liquidity, and community trust - things that matter more than cost.