Privacy Coin Regulations and Delisting: What You Need to Know in 2025

Dec, 16 2024

Dec, 16 2024

Privacy Coin Compliance Checker

Check if privacy coins are legal in your country and understand your options for accessing them based on current regulations.

Regulatory Status

Access Options

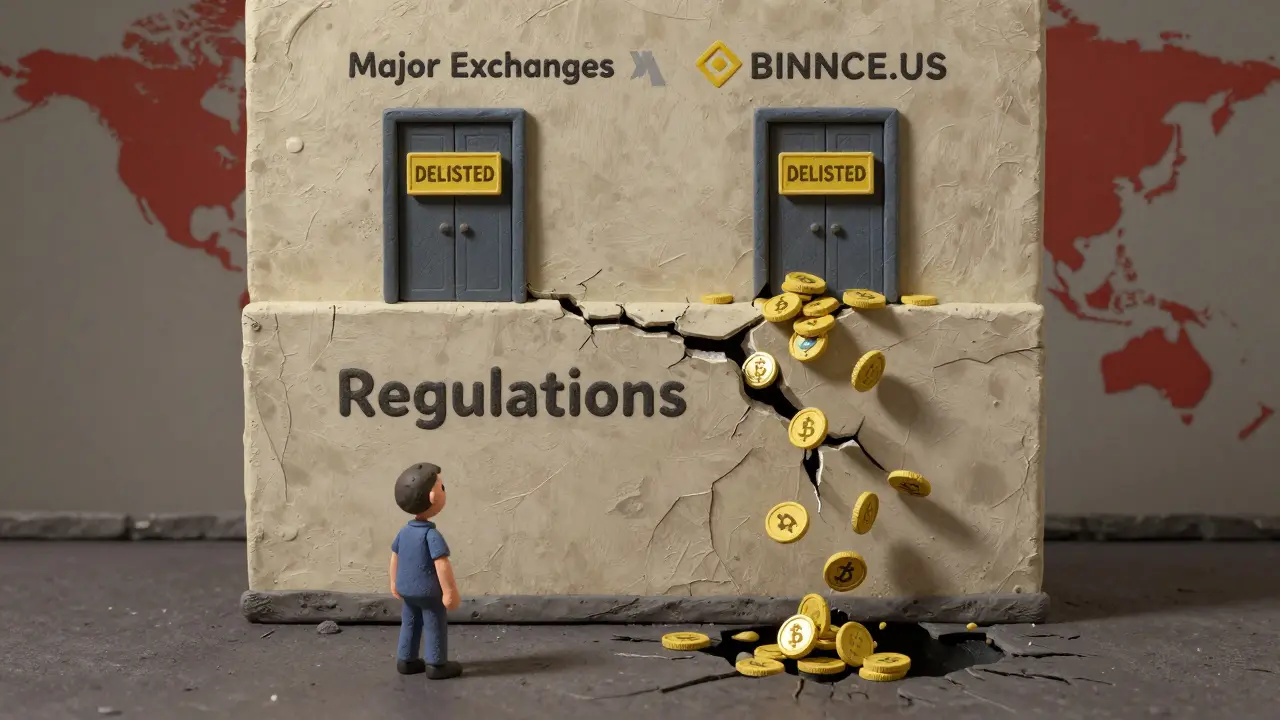

By 2025, if you’re still holding Monero or Zcash, you’re navigating one of the most hostile environments any cryptocurrency has ever faced. It’s not about price swings or hype-it’s about whether these coins can even be traded legally where you live. Governments aren’t just watching privacy coins; they’re actively removing them from exchanges, tightening laws, and making it harder than ever to use them without risking legal trouble.

Why Privacy Coins Are Under Fire

Privacy coins like Monero, Zcash, and Dash were built to hide transaction details. That’s their whole point. Unlike Bitcoin, where every transfer is visible on a public ledger, Monero uses ring signatures and stealth addresses to scramble who sent what to whom. Zcash lets users toggle between public and shielded transactions. To regulators, this isn’t innovation-it’s a loophole for criminals. The Financial Action Task Force (FATF) has been pushing its Travel Rule since 2019, requiring exchanges to collect and share customer data for transfers over $1,000. Privacy coins can’t comply. They can’t reveal sender or receiver addresses without breaking their core design. That’s why exchanges in the U.S., EU, South Korea, and Japan have quietly-but decisively-delisted them. In the U.S., the Bank Secrecy Act and FinCEN treat crypto firms like banks. If you run an exchange and list Monero, you’re potentially violating anti-money laundering rules. The SEC and CFTC don’t need to classify them as securities to shut them down-just proving they enable untraceable transactions is enough.Where Privacy Coins Are Banned (And Where They’re Not)

South Korea banned privacy coins outright in 2024. Japan followed in early 2025. The European Union’s MiCA regulation doesn’t ban them yet-but it gives regulators the legal power to do so by 2027. Most major EU exchanges like Kraken and Bitstamp have already removed them preemptively. The U.S. hasn’t passed a federal ban, but the message is clear: if you’re a U.S.-based exchange, don’t list privacy coins. Coinbase, Binance.US, Gemini-they all dropped them years ago. Even smaller platforms now avoid them to dodge fines that can run into millions. That doesn’t mean privacy coins are dead. They’re just pushed underground. Countries with looser oversight-like parts of Southeast Asia, Africa, and some Caribbean islands-still allow trading. But if you’re in the U.S. or EU, buying Monero on an exchange is nearly impossible. And if you try to use a U.S.-based wallet to receive it, you could trigger a compliance alert.The Delisting Wave: What It Did to the Market

When exchanges delist a coin, it doesn’t just disappear-it collapses. Liquidity dries up. Bid-ask spreads widen. Prices drop. Monero, once among the top 10 cryptocurrencies by market cap, fell out of the top 20 in 2024. Zcash followed. Why? Because most people don’t know how to use decentralized platforms. They rely on Coinbase or Binance to buy, sell, and store crypto. When those doors close, the average user walks away. Trading volume for privacy coins dropped over 60% between 2023 and 2025, according to Chainalysis data. The few remaining exchanges that still list them are mostly offshore, unregulated, or operate in gray zones. Some are peer-to-peer marketplaces like LocalMonero. Others are decentralized swaps like ThorChain or SideShift. But these platforms lack customer support, insurance, or easy interfaces. If you send funds to the wrong address? Too bad. There’s no help desk.

Where Are Users Going Now?

People who still want privacy aren’t giving up-they’re adapting. Many now use:- Decentralized exchanges (DEXs) like ThorChain or PancakeSwap with privacy-focused token pairs

- Privacy-focused wallets like Monero’s official GUI or Cake Wallet

- Peer-to-peer (P2P) trading through platforms like LocalMonero or Bisq

- Layer-2 privacy tools on Ethereum, like Tornado Cash (though it’s also restricted)

Are Privacy Coins Still Useful?

Yes-but only for specific cases. Regular people don’t need them to pay for coffee or stream music. But there are real, legal reasons someone might want them:- Journalists in authoritarian countries avoiding financial surveillance

- Businesses negotiating mergers without leaking deal terms

- Activists in regions where banking is tied to political repression

- People living under strict capital controls in places like Argentina or Nigeria

What’s Next? The Future of Privacy Coins

Two paths are emerging: Path 1: Integration - Privacy features get built into bigger blockchains. Ethereum is testing zk-SNARKs for private DeFi transactions. Solana and Cardano are experimenting with confidential smart contracts. If privacy becomes a feature, not a coin, standalone privacy coins may fade. You won’t need Monero-you’ll just use a private wallet on Ethereum. Path 2: Underground Survival - Privacy coins become niche tools for those who accept the risk. Trading happens on decentralized networks. Development continues in small teams. Use cases remain limited to high-risk, high-reward scenarios. They’ll survive-but never go mainstream. Some projects are trying to split the difference. Zcash’s developers are exploring optional compliance modes. Monero’s team refuses to compromise. That divide is growing.What Should You Do?

If you own privacy coins:- Know your local laws. In some countries, holding them is legal but trading them isn’t.

- Don’t use a KYC’d exchange to buy or sell them. Use a non-custodial wallet instead.

- Store them in a dedicated wallet-don’t mix them with Bitcoin or Ethereum.

- Understand the risks: if you’re caught using them illegally, penalties can include fines or jail time.

- Ask yourself: Why do I need privacy? Is it for security, or to hide something?

- Can you handle the technical complexity? If not, you’re better off with Bitcoin or Ethereum.

- Are you prepared to lose access to your funds if you make a mistake?

Final Thoughts

Privacy coins aren’t going away. But they’re no longer for everyone. They’ve become tools for the few who need them most-and who are willing to pay the price in complexity, risk, and isolation. The real question isn’t whether they’ll survive. It’s whether society will accept that privacy in finance isn’t a bug-it’s a feature. Until then, these coins will live in the shadows, used by those who can’t afford to be seen.Are privacy coins illegal?

No, privacy coins aren’t outright illegal in most countries as of 2025. But in places like the U.S., EU, South Korea, and Japan, trading them on regulated exchanges is banned. Holding them isn’t a crime-but using them for illegal purposes is. Some countries are moving toward full bans by 2027.

Why did exchanges delist Monero and Zcash?

Exchanges delisted them because they can’t comply with anti-money laundering (AML) and Know Your Customer (KYC) rules. Monero hides sender, receiver, and amount by design. Zcash’s shielded transactions make traceability impossible. Regulators require transparency, so exchanges chose to remove them to avoid fines and legal action.

Can I still buy Monero in the U.S.?

You can’t buy Monero on U.S.-based exchanges like Coinbase or Binance.US. But you can still acquire it through decentralized platforms like ThorChain, SideShift, or peer-to-peer services like LocalMonero. These don’t require ID verification, but they’re riskier and harder to use.

Is Zcash safer than Monero because it has optional privacy?

Technically, yes-Zcash lets you choose between transparent and shielded transactions. But regulators don’t care about the choice. If the coin can be used to hide transactions, it’s treated as non-compliant. Most exchanges delisted Zcash anyway because even a small number of shielded transactions can’t be traced.

What’s the difference between privacy coins and Bitcoin?

Bitcoin transactions are fully public. Anyone can see how much was sent, and to which addresses-though not always who owns them. Privacy coins like Monero and Zcash hide sender, receiver, and amount by default. Bitcoin is pseudonymous. Privacy coins are anonymous.

Will privacy coins ever come back to major exchanges?

Only if they change their core technology. If a privacy coin introduces mandatory transparency for regulators-like a backdoor or compliance mode-it might get relisted. But that would defeat the purpose for most users. Right now, the industry sees it as a trade-off: compliance or anonymity. Most choose anonymity.

Are privacy coins used for crime?

Yes, they’ve been used in criminal activity-like ransomware payments and darknet markets. But so have Bitcoin and traditional cash. Studies show less than 1% of all Monero transactions are linked to crime. The problem is that regulators treat the entire category as risky because of a few bad actors.

Can I use privacy coins for payroll or business payments?

It’s legally risky. Most payroll platforms require KYC and AML compliance. Using privacy coins for business payments could trigger audits or fines. Some startups are experimenting with hybrid models, but they’re rare and operate in legal gray areas. For now, it’s not advisable unless you’re in a jurisdiction with no oversight.

Jon Visotzky

December 5, 2025 AT 02:22So let me get this straight - if I want to keep my financial history private, I’m the bad guy? Meanwhile banks move billions around with zero transparency and nobody calls it a crime. This feels less like regulation and more like control disguised as safety.

Chris Mitchell

December 5, 2025 AT 20:42Privacy isn't a bug. It's a human right. If you can't trust the system, you build tools to protect yourself. That's not criminal - that's common sense.

Martin Hansen

December 6, 2025 AT 14:23Monero users are just crypto anarchists with delusions of grandeur. You think hiding your transactions makes you some kind of digital Robin Hood? Nah. You're just making it easier for actual criminals. Grow up.

Lore Vanvliet

December 8, 2025 AT 07:46OMG I JUST LOST MY ENTIRE MONERO WALLET BECAUSE I USED A DEX AND NOW I'M BROKE 😭😭😭 THIS IS WHY WE NEED GOVERNMENT PROTECTION!!!

Frank Cronin

December 9, 2025 AT 15:26Oh wow, a whole article about how people who don't want to be tracked are 'criminals' - and you're surprised they're getting pushed underground? Maybe if you stopped treating privacy like a felony, people wouldn't have to go full spy movie just to buy coffee.

Shane Budge

December 11, 2025 AT 06:43How do you even buy Monero now if you're in the US?

sonia sifflet

December 11, 2025 AT 10:45Actually in India we still have some P2P platforms that allow Monero trading. The government hasn't banned it yet because they're too busy chasing crypto influencers. But I'm not sure how long that'll last. Better move your coins now.

Chris Jenny

December 12, 2025 AT 14:29They're not just delisting coins... they're building the surveillance state. This is step one. Next they'll track your grocery purchases. Then your thoughts. The deep state is using AML as an excuse to erase all financial freedom. I've seen the documents. They're coming for us all.

Uzoma Jenfrancis

December 12, 2025 AT 15:38Monero is for the people. The rich use banks. The poor use cash. The real rebels use Monero. They think they can stop us? We’ve been doing this since before they had smartphones. This is just another chapter.