Staying Informed About Changing Crypto Regulations Worldwide

Aug, 30 2025

Aug, 30 2025

Crypto Compliance Checker

Check if your crypto activities comply with current regulations based on your jurisdiction and actions. This tool is based on 2025 regulatory updates.

Compliance Status

Keeping up with crypto regulations isn’t just for lawyers or compliance officers anymore. If you’re holding Bitcoin, trading Ethereum, or even just curious about NFTs, you’re already in the crosshairs of global rules that are changing faster than ever. In 2025, the landscape isn’t just shifting-it’s being rebuilt. What was legal last year might be banned this month. What was ignored yesterday might now require a license. Ignoring this isn’t an option anymore.

What’s Actually Changing Right Now?

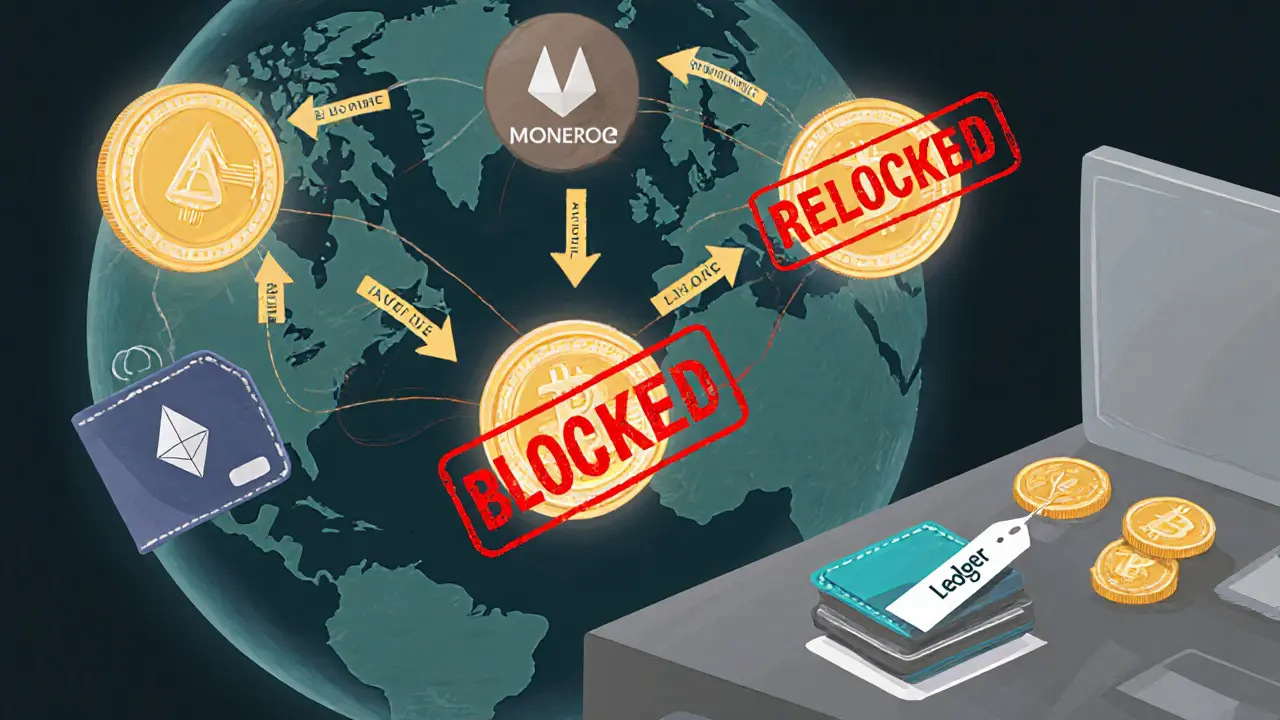

The biggest shift happened in the U.S. in early 2025. After years of the SEC chasing crypto companies with lawsuits, the new administration dropped the hammer on enforcement. On February 27, 2025, the SEC officially said memecoins like Dogecoin and Shiba Inu are no longer securities. That’s huge. It means you can trade them without worrying about federal securities law violations. OpenSea and Robinhood had their investigations closed. Coinbase’s legal battles were dismissed. For the first time in years, crypto companies in America got a breath of fresh air. But it’s not all sunshine. The U.S. still doesn’t have a single federal crypto law. Instead, two big bills are moving through Congress. The Stablecoin Trust Act would force stablecoin issuers like USDC and USDT to prove they hold enough cash or safe assets to back every coin. They’d need to store those reserves separately, get audited monthly, and report to both the Federal Reserve and the OCC. The FIT Act would finally split the job: the SEC handles tokens that act like stocks, the CFTC handles those that act like commodities like Bitcoin and Ethereum. This should end the endless tug-of-war between regulators. Still, enforcement hasn’t disappeared. OKX pleaded guilty in February 2025 to running an unlicensed money service business and paid millions. FinCEN is pushing new rules that would treat Bitcoin and Ether as "monetary instruments" under the Bank Secrecy Act. That means banks and crypto exchanges would have to report transactions over $10,000 involving unhosted wallets-like MetaMask or Ledger. If you’re moving crypto from an exchange to your own wallet and back, that could trigger new paperwork.Europe’s Tight Grip

The EU’s MiCAR regulation is now fully in effect. It’s the most detailed crypto rulebook in the world. Every exchange, wallet provider, and token issuer operating in Europe must be licensed. They need to prove they have enough capital, protect customer funds, and disclose every detail about their tokens. No more shady whitepapers. No more anonymous teams. If you’re a European user, you’ll notice more transparency. If you’re a business, you’re looking at a year-long compliance grind. Countries like Germany and France are using MiCAR to attract crypto firms by offering faster licensing. Others, like Italy and Spain, are dragging their feet. The result? A patchwork of rules within a single regulatory zone. If you’re running a crypto business across the EU, you can’t just follow one set of rules-you need to track which country’s version applies to each customer.Asia Is Winning the Crypto Race

While the U.S. and EU debate, Asia is building. Hong Kong launched its own crypto exchange licensing system in 2025. To operate, exchanges must meet strict custody rules, have local offices, and submit to regular audits. They can now offer crypto derivatives and lending services-but only under tight limits. Singapore didn’t wait. It finalized its own stablecoin rules, requiring full reserve backing and daily audits. Both places are actively recruiting crypto firms with tax incentives and clear rules. The message is simple: if you want to build crypto products, come here. You’ll get legal certainty, not legal chaos. That’s why more than 120 new crypto firms moved their headquarters to Hong Kong or Singapore in 2025. The U.S. and EU are catching up, but Asia is already ahead.

Global Rules Are Starting to Align

You can’t regulate Bitcoin with national laws alone. That’s why global bodies are stepping in. The Basel Committee just set new rules for banks: if they hold Bitcoin or other crypto assets, they must set aside 12.5% of the asset’s value as capital. That’s the same as lending to a risky startup. It’s not a ban-but it’s a warning. Banks will think twice before touching crypto. The Financial Action Task Force (FATF) tightened its "travel rule" guidelines. Now, every crypto transaction over $1,000 must include sender and receiver info. Exchanges have to pass this data along. That’s killing privacy-focused chains like Monero and Zcash in regulated markets. The Bank for International Settlements is pushing for global standards on stablecoins and CBDCs, warning that unregulated stablecoins could trigger the next financial crisis.How to Stay Updated Without Losing Your Mind

You don’t need to read every press release. Here’s how to stay ahead:- Track the big three regulators: SEC (U.S.), ESMA (EU), and SFC (Hong Kong). They’re the ones making the real rules.

- Subscribe to official updates: The SEC, FinCEN, and FATF publish rule changes on their websites. Set up email alerts.

- Use compliance tools: Platforms like Chainalysis and Elliptic update their risk flags daily. If your exchange says a coin is "restricted," don’t ignore it.

- Know your jurisdiction: If you live in California, your state’s money transmitter rules apply. If you’re in Germany, MiCAR overrides state law. Don’t assume federal rules cover everything.

- Watch for enforcement: If a major exchange gets fined or shuts down in one country, check if it affects your region. Regulators copy each other.

What’s Next? The Big Questions

Will the U.S. pass a federal crypto law by the end of 2025? Most experts say yes. Stablecoin regulation has bipartisan support. The question is whether they’ll include DeFi and NFTs-or leave them in legal gray zones. Will China ever open up? Unlikely. But it’s quietly testing its own digital yuan in 15 cities, and it’s already blocking crypto transactions from overseas exchanges. That’s not regulation-it’s control. Will privacy coins survive? Probably not in regulated markets. The FATF’s travel rule is too strong. Privacy-focused wallets will move to unregulated zones-or disappear.What This Means for You

If you’re holding crypto: know where you live. Your local rules matter more than what’s happening in the U.S. or EU. If you’re trading: avoid tokens that are flagged as high-risk. If you’re investing: don’t assume a coin is safe just because it’s on Coinbase or Binance. Those platforms are now forced to pull coins that violate new rules. The crypto world isn’t wild anymore. It’s regulated. And the rules are getting stricter, not looser. The winners won’t be the ones who predicted the price of Bitcoin. They’ll be the ones who stayed informed, adapted fast, and didn’t wait for someone else to warn them.Are memecoins legal now in the U.S.?

Yes, as of February 27, 2025, the SEC no longer considers memecoins like Dogecoin or Shiba Inu to be securities. That means you can buy, sell, and trade them without violating federal securities law. However, exchanges still need to comply with anti-money laundering rules, and state-level regulations may still apply.

Do I need to report crypto transactions to the IRS?

Yes. Even with relaxed SEC enforcement, the IRS still requires you to report all crypto sales, trades, and income. If you sold Bitcoin for profit, earned staking rewards, or received crypto as payment, you must report it on your tax return. FinCEN’s new rules may add reporting for unhosted wallet transactions over $10,000, but that’s still pending final approval.

Can I still use a hardware wallet like Ledger or Trezor?

Absolutely. Hardware wallets are not banned anywhere. But if you move crypto to or from an unhosted wallet (like your Ledger) and the transaction is over $10,000, your exchange may be required to report it under FinCEN’s proposed rules. Your wallet itself is fine-it’s the transaction flow that’s being tracked.

Is Bitcoin considered money now?

Not officially. But under FinCEN’s 2025 proposal, Bitcoin and Ether would be classified as "monetary instruments" under the Bank Secrecy Act. That doesn’t make them legal tender, but it means financial institutions must treat them like cash for reporting purposes. This is a big step toward formal recognition-but not full legal status.

What happens if I ignore crypto regulations?

You risk fines, frozen assets, or even criminal charges. In 2025, the U.S. and EU are going after not just exchanges, but individual users who knowingly evade reporting. If you’re moving large amounts of crypto to avoid taxes or hide activity, regulators are now equipped to trace it. Ignorance isn’t a defense anymore.

Which countries are crypto-friendly in 2025?

Hong Kong, Singapore, and Switzerland lead the pack. They offer clear licensing, tax certainty, and legal protection for crypto businesses. The U.S. is becoming more permissive but still lacks federal clarity. The EU is strict but predictable under MiCAR. Countries like El Salvador and the UAE are also welcoming, but with more risk and less institutional support.

Savan Prajapati

November 26, 2025 AT 10:02This whole post is just corporate propaganda dressed up as advice. Memecoins are legal? Cool. So now I’m supposed to trust exchanges that just got off the hook for years of fraud? LOL. I’ve seen this movie before.

Regulators don’t care about you. They care about control. They’ll let you trade Dogecoin until they figure out how to tax it better. Then they’ll slap you with a $10k reporting requirement and call it ‘transparency.’

Stop pretending this is about consumer protection. It’s about who gets to profit from your money.

Michael Labelle

November 27, 2025 AT 06:31Honestly, I’ve been watching this play out for years. The SEC’s flip-flopping was exhausting. I’m glad memecoins got clarity, even if it’s just because they’re too chaotic to regulate properly.

Still, the FinCEN stuff is the real sleeper hit. If they start tracking unhosted wallet transfers over $10k, it’s going to kill the whole ‘self-custody’ dream for regular folks. Not because it’s illegal-but because the paperwork becomes a nightmare.

Just keep your eyes on the big exchanges. If they drop a coin, it’s not because it’s risky-it’s because compliance said so.

Vance Ashby

November 27, 2025 AT 18:42Bro. The U.S. still has NO federal crypto law. Like… none. Zero. Zip.

SEC says one thing, CFTC says another, FinCEN drops a bomb, and then Congress just yawns. Meanwhile, Singapore’s out here handing out golden tickets to crypto firms like it’s a free lunch.

Also, if you’re using Ledger and think you’re anonymous… you’re not. 😅

They don’t care about your wallet. They care about the exchange you came from. And that’s the backdoor.

Brian Bernfeld

November 28, 2025 AT 03:25Let me break this down real simple for anyone still confused.

Yes, Dogecoin is legal to trade in the U.S.-but only because it’s too stupid to be a security. Not because it’s safe. Not because it’s legit. Just because the SEC gave up.

Meanwhile, MiCAR in Europe is the most detailed crypto rulebook ever written. It’s like the EU took every scam from 2017–2024 and turned it into a checklist. Exchanges? Licensed. Tokens? Disclosed. Teams? Public. No more anonymous devs with Discord links.

And Asia? They’re not just regulating-they’re building infrastructure. Hong Kong’s exchange licensing isn’t a suggestion. It’s a requirement with teeth. If you’re running a crypto business and you’re not in HK, Singapore, or Switzerland… you’re playing Russian roulette with your bank account.

Also, if you think Bitcoin is ‘money’ now? Nope. It’s a ‘monetary instrument.’ That’s legalese for ‘we treat it like cash, but we still don’t call it currency.’ Big difference.

And yes, privacy coins are dead in regulated markets. Monero? Zcash? They’re not banned-but they’re effectively invisible on any exchange that wants to stay open. The FATF travel rule is a death sentence for anonymity.

Bottom line: The wild west is over. The new frontier is compliance. If you’re not reading the rules, you’re not a crypto investor-you’re a liability waiting to happen.

Casey Meehan

November 28, 2025 AT 16:51Just don’t move >$10k to your Ledger. That’s all you need to know. 🚨