Blockchain Oracles: How Real-World Data Powers Smart Contracts

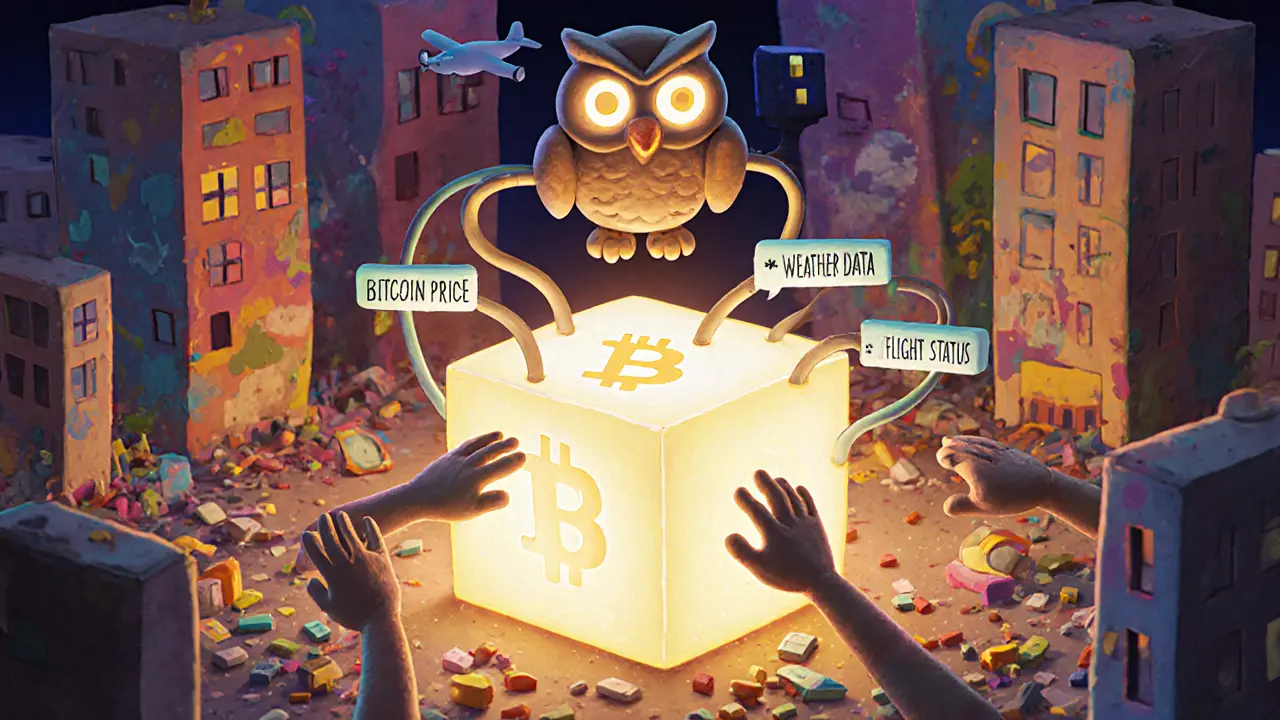

When you hear blockchain oracles, external data sources that feed real-world information into smart contracts on a blockchain. Also known as data oracles, they’re the bridge between what happens on-chain and what happens in the real world—like stock prices, weather reports, or the winner of a football match. Without them, smart contracts are stuck in a bubble. They can’t know if a flight was delayed, if a crop failed, or if Bitcoin hit $70,000. Oracles make automation possible.

Think of a simple insurance smart contract that pays out if a flight is canceled. Without an oracle, it has no way to check the airline’s official status. But with one, it pulls live data from a trusted source and triggers the payout automatically. That’s the power. But here’s the catch: if the oracle is wrong, or hacked, the whole contract fails. That’s why the best oracles don’t rely on a single source. They use multiple data feeds, cross-check them, and only act when there’s consensus. Projects like Chainlink, a decentralized oracle network that aggregates data from many providers to reduce single points of failure built their entire model around this idea. It’s not just about getting data—it’s about trusting it.

Oracles aren’t just for finance. They’re used in supply chains to track shipments, in gaming to verify random events, and even in energy markets to trigger payments when solar output hits a certain level. But most of the posts you’ll see here don’t talk about the tech—they talk about the risks. You’ll find reviews of platforms that claim to use oracles but don’t verify their data. You’ll see tokens tied to fake price feeds. You’ll find exchanges that pretend to offer automated payouts based on real-world events, but have no real oracle integration at all. The truth is, most projects don’t build oracles—they just say they do. And that’s where users lose money.

What you’ll find below isn’t a theory lesson. It’s a collection of real cases where oracles mattered—or failed. Some posts show how bad data led to massive losses. Others expose scams hiding behind the word "oracle." A few even explain how to spot a fake oracle setup before you invest. This isn’t about hype. It’s about knowing what’s real when a blockchain is supposed to act on something outside its own system. If you’ve ever wondered why a smart contract didn’t pay out, or why a DeFi protocol collapsed overnight, the answer often starts with an oracle.

What Are Blockchain Oracles? A Clear Guide to How They Connect Smart Contracts to the Real World

Blockchain oracles connect smart contracts to real-world data like prices, weather, and sensor readings. Without them, blockchains can't interact with external systems. Learn how they work, why they matter, and which networks are leading the space.