Crypto Tax India: What You Need to Know About Reporting Crypto Gains in 2025

When you trade or sell cryptocurrency in India, the crypto tax India, a 30% flat tax on capital gains from digital assets with no loss offset allowed. Also known as cryptocurrency gains tax, it applies whether you swap Bitcoin for Ethereum, cash out stablecoins, or earn rewards from staking. Unlike in some countries, India doesn’t treat crypto as currency—it’s classified as a virtual digital asset, and every sale, trade, or conversion triggers a taxable event.

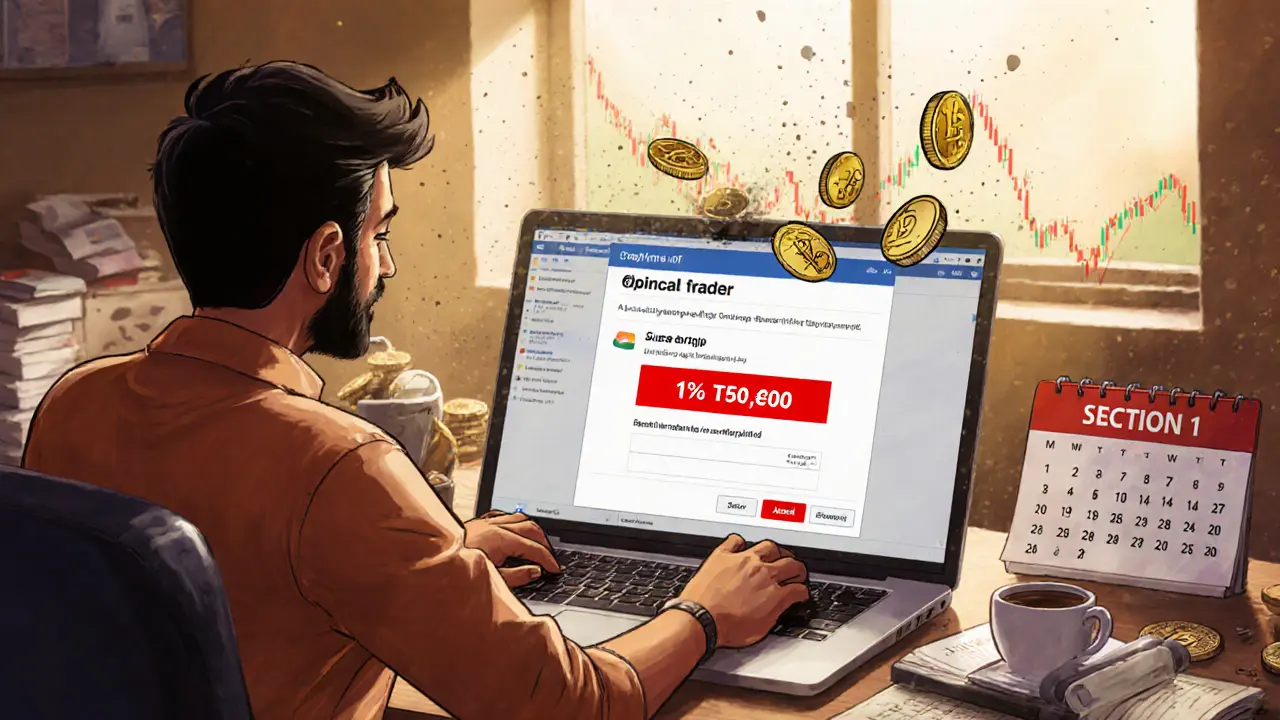

The Indian crypto taxation, rules enforced by the Income Tax Department since April 2022. Also known as crypto reporting India, it requires you to track every transaction: buys, sells, swaps, and even airdrops received. Even if you didn’t convert crypto to INR, trading one coin for another is still taxable. There’s no exemption for long-term holdings—whether you held Bitcoin for 10 days or 10 years, the tax rate stays at 30%. Plus, a 1% TDS applies on every trade over ₹50,000 (or ₹10,000 in a single month), deducted by exchanges like WazirX or CoinDCX before your funds leave the platform. If you mine crypto or earn it from staking, the value at the time you receive it counts as income and gets taxed at your slab rate. That means if you earn $1,000 worth of SOL from staking and your income bracket is 30%, you owe ₹30,000 in tax on that single payout.

Many people assume they can avoid taxes by using foreign exchanges or keeping crypto in cold wallets—but the Indian government can track on-chain activity through exchange data sharing, KYC records, and blockchain analysis tools. The IT Department has already matched thousands of wallets with PAN cards. Failing to report can lead to penalties up to 200% of the tax due, or even prosecution under the Income Tax Act. If you’re holding crypto as an investment, you must file ITR-2 and declare gains under Schedule CG. No form, no excuse.

What you’ll find below are real-world examples of how Indian crypto users got hit with tax bills, how to calculate your liability step-by-step, which exchanges provide tax reports, and what common mistakes cost people thousands. These aren’t theory pieces—they’re based on actual filings, notices from the tax department, and user experiences from 2024 and early 2025. Whether you traded once or traded daily, this collection gives you the facts you need to stay on the right side of the law.

1% TDS on Crypto Transactions in India: What You Need to Know in 2025

India's 1% TDS on crypto transactions, introduced in 2022, deducts tax at the point of trade. Learn how it works, who it affects, and how it stacks up against India's 30% crypto tax and GST on fees.