Decentralized Oracle Network: What It Is and Why It Matters in Crypto

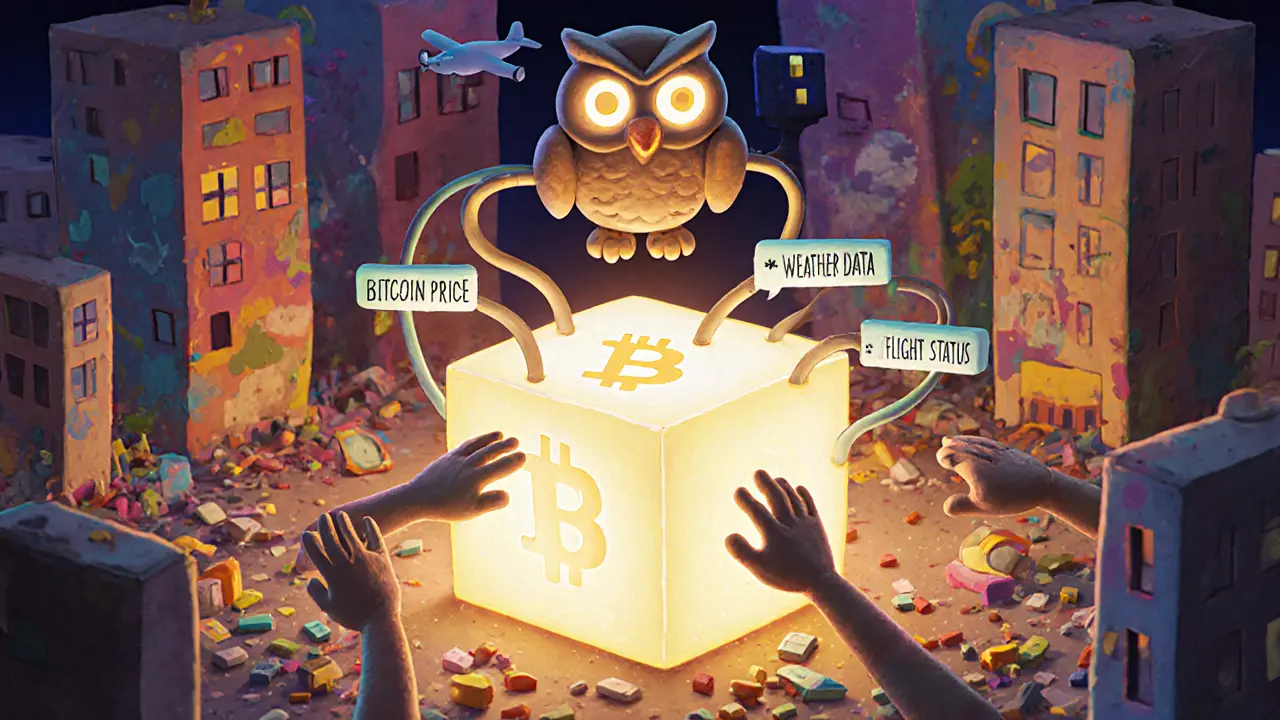

When you think of blockchain, you might picture Bitcoin transfers or DeFi trades—but none of that works without decentralized oracle network, a system that securely connects blockchains to real-world data like prices, weather, or sports results. Also known as blockchain oracles, it’s the invisible bridge that lets smart contracts react to things happening outside the chain. Without it, a smart contract can’t know if a stock price rose, if a flight was delayed, or if Bitcoin hit $60K. It’s like giving a computer a blindfold and asking it to drive a car.

That’s where Chainlink, the most widely used decentralized oracle network, pulling data from hundreds of sources to avoid single points of failure comes in. It doesn’t rely on one server or one data provider. Instead, it asks dozens of independent nodes to report the same info—like a jury of witnesses—and only accepts the result if most agree. This stops hackers from feeding fake prices to a DeFi loan platform, which could otherwise drain millions. Other networks like Band Protocol, a multi-chain oracle solution used across Cosmos and Binance Smart Chain and Pyth Network, built for high-speed financial data from institutional traders do the same thing, just with different approaches.

Why does this matter to you? Because every time you stake, lend, or trade on a DeFi app, you’re relying on an oracle to tell the system what’s real. If the oracle lies, your money vanishes. That’s why audits, node diversity, and data source reliability aren’t just tech details—they’re survival skills. You can’t trust a smart contract that only checks one price feed from one company. Real security means multiple sources, cross-checked, on-chain, and cryptographically signed.

And it’s not just about crypto prices. Oracles power insurance payouts when a hurricane hits, automated supply chain payments when goods arrive, and even sports betting that auto-pays winners. The decentralized oracle network turns blockchain from a closed ledger into an open system that can interact with the real world—without needing a middleman.

Below, you’ll find real-world examples of what happens when oracles fail, how projects like Chainlink keep things running, and why some DeFi tokens crash not because of bad code—but because the data they trusted was wrong. You’ll also see how exchanges and protocols use oracles to make trading safer, and why ignoring this layer is like driving without checking your mirrors.

What Are Blockchain Oracles? A Clear Guide to How They Connect Smart Contracts to the Real World

Blockchain oracles connect smart contracts to real-world data like prices, weather, and sensor readings. Without them, blockchains can't interact with external systems. Learn how they work, why they matter, and which networks are leading the space.