Smart Contracts: What They Are and How They Power Crypto Today

When you hear smart contracts, self-executing agreements coded directly onto a blockchain that run without human intervention. Also known as blockchain contracts, they’re the reason you can trade tokens, earn interest on crypto, or buy an NFT without calling a bank or lawyer. Think of them like digital vending machines: you put in the right input (like sending ETH), and they automatically spit out the result (like an NFT or a payout)—no middleman needed.

Most Ethereum, the leading blockchain platform for running smart contracts since 2015 is built around them. But they’re not just for Ethereum—DeFi, a whole ecosystem of financial apps that replace banks using blockchain lives on smart contracts. That’s how you lend, borrow, or farm yields without a central company holding your money. The same tech powers NFT marketplaces, tokenized assets, and even automated insurance payouts. But here’s the catch: if the code has a flaw, the money is gone forever. No customer service, no refunds. That’s why so many posts here warn about projects like NiHao or Sphynx Labs—because their smart contracts can be changed by the creators, making them risky or even scams.

Not all smart contracts are created equal. Some are open-source and audited by third parties. Others are hidden, untested, and locked with no way to fix bugs. That’s why understanding how they work matters—not just for trading, but for staying safe. You’ll find posts here breaking down real cases: how a faulty contract led to a $40 million loss, why some exchanges like SkullSwap are dangerous because their contracts aren’t verified, and how platforms like STON.fi and StellaSwap use clean, reliable code to keep users protected. You’ll also see how smart contracts tie into bigger trends—like energy trading, tokenized stocks, and even government asset seizures—because once something is on-chain, it’s hard to undo.

Whether you’re trading, investing, or just trying not to get ripped off, smart contracts are the invisible engine behind most crypto actions today. The good ones save time and money. The bad ones cost you everything. Below, you’ll find real-world examples of both—and the lessons you need to avoid becoming a statistic.

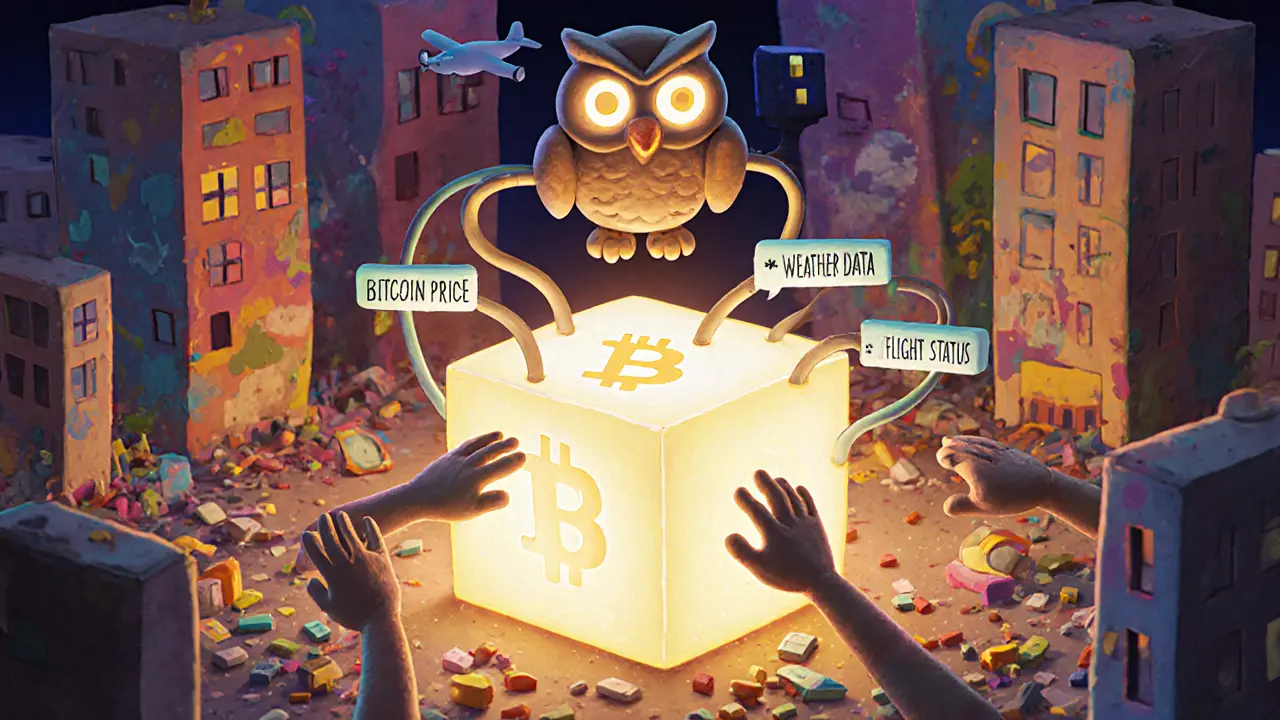

What Are Blockchain Oracles? A Clear Guide to How They Connect Smart Contracts to the Real World

Blockchain oracles connect smart contracts to real-world data like prices, weather, and sensor readings. Without them, blockchains can't interact with external systems. Learn how they work, why they matter, and which networks are leading the space.