Unlicensed Crypto Mining in Iran: How the IRGC Controls the Industry

Dec, 19 2024

Dec, 19 2024

Iran Power Grid Impact Calculator

With 0 hours of outage, hospitals lose backup power for 0 hours and factories lose $0 per outage.

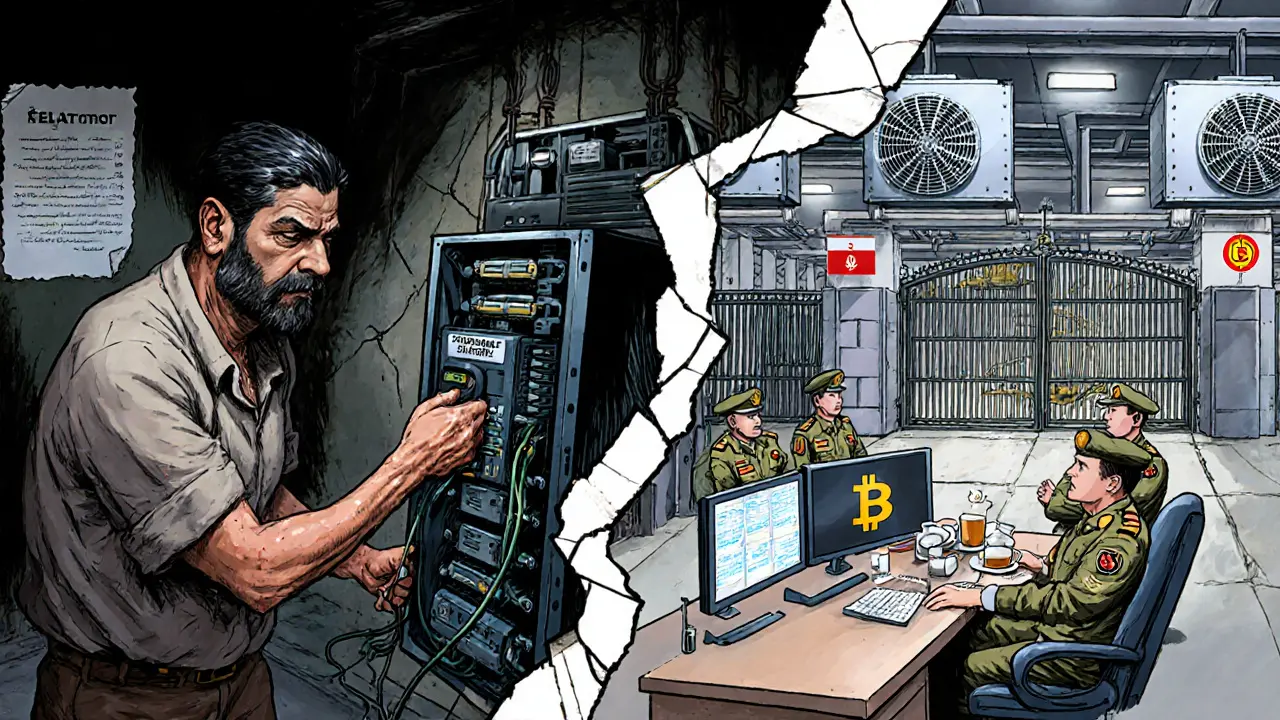

On a cold winter night in Tehran, thousands of homes sit in darkness. The heaters are off. The lights are out. Meanwhile, just miles away, rows of humming Bitcoin mining rigs run nonstop - powered by electricity that was never paid for, and never meant for them. This isn’t science fiction. It’s Iran’s reality, where the Islamic Revolutionary Guard Corps (IRGC) runs the country’s biggest crypto mining operation - and ordinary Iranians pay the price.

How Crypto Mining Became a State Weapon

Iran’s crypto mining boom didn’t start as a tech trend. It started as a survival tactic. After U.S. and European sanctions cut off Iran’s access to global banking systems in the 2010s, the regime needed a way to move money without banks. Cryptocurrency offered a solution: direct, anonymous, borderless transactions. But unlike in other countries, where individuals mine Bitcoin as a side hustle, Iran’s mining industry was quickly taken over by the state. By 2019, the IRGC - Iran’s elite military and intelligence force - began building massive mining farms. These weren’t small setups in basements. They were industrial-scale operations, each consuming tens of megawatts of electricity. One known facility in Rafsanjan, Kerman Province, alone uses 175 megawatts - enough to power a small city. The equipment? Mostly imported from China. The power? Taken from the national grid. The profits? Kept by the IRGC and its affiliated religious foundations like Astan Quds Razavi. The Iranian government officially legalized crypto mining in 2019, but the rules were rigged from the start. Licensed miners had to pay high electricity rates and sell their Bitcoin to the Central Bank of Iran at fixed prices. For private operators, that meant losing money. Meanwhile, IRGC-linked miners paid nothing. They didn’t even have to connect to the official grid. They built their own private power lines - a privilege granted by a 2022 law that let the military create its own electricity infrastructure.The Two-Tiered System: Who Gets Power, Who Doesn’t

Iran’s electricity supply is stretched thin. In 2024, cities like Isfahan and Shiraz faced daily blackouts lasting up to 12 hours. Factories shut down. Hospitals ran on generators. And yet, crypto mining farms kept running - 24/7. Estimates suggest Iran has around 180,000 active mining devices. Of those, only about 80,000 belong to private citizens. The rest - roughly 100,000 units - are controlled by state-backed entities. That means more than half of Iran’s crypto mining is unlicensed, hidden behind military bases, religious endowments, or shell companies tied to the IRGC. These operations don’t just use electricity. They hoard it. When the grid goes down in Tehran, it’s often because mining farms are drawing so much power that civilian neighborhoods get cut off. Energy Minister Ali Abadi - a former IRGC commander himself - called this theft. “It’s like putting a hand in someone else’s pocket,” he said in 2023. But no one was punished. No farms were shut down. The same people who spoke out were the ones running the mines.

How the IRGC Avoids Detection

The IRGC doesn’t just mine Bitcoin. It uses it to bypass sanctions. Blockchain analysts have traced Bitcoin wallets linked to IRGC-affiliated addresses that fund militias in Syria, Yemen, and Iraq. These aren’t random transactions. They’re structured payments - Bitcoin sent directly to digital wallets controlled by proxy groups, avoiding banks, intermediaries, and paper trails. Unlike traditional wire transfers, which leave audit trails, cryptocurrency moves in the shadows. A single Bitcoin transaction can be sent from Tehran to Damascus in minutes, with no bank involved. That’s why U.S. Treasury officials and Israeli intelligence have repeatedly targeted Iranian crypto wallets. In 2024, the U.S. sanctioned two Iranian mining companies tied to the IRGC, freezing their digital assets. The response? More mining. More hidden farms. More power diverted. The IRGC also uses foreign partnerships to stay anonymous. Chinese firms supply the mining hardware. Turkish and UAE-based exchanges help convert Bitcoin into cash. Even when regulators crack down, the money flows through layers of intermediaries - making it nearly impossible to trace back to the source.Why Private Miners Are Crushed

Regular Iranians who try to mine crypto legally face impossible odds. They pay 300% more for electricity than IRGC operations. They’re forced to sell their Bitcoin to the Central Bank at prices set by the state - often below market value. Some miners report losing thousands of dollars a month just to stay compliant. Many have given up. Others went underground. Some use VPNs to access foreign exchanges like Nobitex, hoping to sell their coins at fair prices. But even that’s risky. In December 2024, Iran’s Central Bank blocked all domestic crypto-to-rial transactions. By January 2025, they reopened them - but only through government-controlled APIs that track every user’s identity, wallet, and transaction history. This isn’t about stopping crypto. It’s about controlling it. The regime doesn’t want citizens to profit from mining. It wants to be the only one who does.

The Human Cost of State-Sponsored Mining

The numbers tell one story. The lived experience tells another. In Mashhad, a mother of three says her son’s asthma inhaler stopped working for three days because the hospital’s backup generator ran out of fuel. In Tabriz, a textile factory lost $200,000 in orders because power outages halted production. In rural areas, children study by candlelight. Meanwhile, IRGC mining farms operate in sealed compounds, guarded by armed personnel. They don’t need permits. They don’t answer to regulators. They don’t pay bills. They don’t care about blackouts. This isn’t corruption. It’s institutionalized theft. And it’s built into Iran’s energy policy.What’s Next for Iran’s Crypto Wars

The Iranian government claims it’s cracking down on illegal mining. But every new regulation seems designed to tighten control, not end it. The latest move - allowing only state-approved crypto exchanges - confirms the goal: monopolize the industry. There’s no sign the IRGC will give up mining. The profits are too high. The protection is too strong. And the power grid? It’s already broken. The regime doesn’t need to fix it. It just needs to keep feeding its machines. For now, the only way ordinary Iranians can access crypto is by breaking the law - using VPNs, peer-to-peer trades, or smuggling hardware. But even that’s becoming harder. The state is expanding surveillance. The penalties are growing harsher. The real question isn’t whether Iran will stop unlicensed mining. It’s whether the world will stop ignoring it. Because while the rest of the world debates crypto’s environmental impact, Iran is using it to fund war, steal power, and punish its own people.Is cryptocurrency mining legal in Iran?

Technically, yes - but only for state-approved operators. The Iranian government issued licenses in 2019, but the rules heavily favor IRGC-linked entities. Private miners face high electricity costs and mandatory sales to the Central Bank, making legal mining unprofitable. Most private operations operate illegally, while the IRGC runs large-scale mining under the radar with direct access to subsidized power.

How does the IRGC profit from crypto mining?

The IRGC doesn’t just mine Bitcoin - it uses it to bypass sanctions. Bitcoin mined in Iran is sold on foreign exchanges and converted into cash to fund proxy militias in Syria, Yemen, and Iraq. The IRGC controls mining farms through military bases and religious foundations like Astan Quds Razavi, which receive free electricity and operate without oversight. Profits flow directly into regime-controlled accounts, avoiding international banking systems entirely.

Why do Iranian citizens face power outages while mining farms run 24/7?

IRGC-linked mining operations consume an estimated 100,000+ mining units - far more than private miners. These farms are connected to private power lines built with military approval and receive electricity at no cost. Meanwhile, civilian areas are cut off during peak demand. In 2024, Iran’s energy ministry admitted that unauthorized mining contributed to nationwide blackouts. The state has no incentive to stop it because it benefits from the profits.

Can Iranians legally buy or sell cryptocurrency?

Iranians can trade crypto, but only through government-approved platforms. Since December 2024, all domestic crypto-to-rial transactions must go through a state-controlled API that tracks users’ identities and wallets. Foreign exchanges like Nobitex are blocked unless accessed via VPN, which is technically illegal. The goal isn’t to ban crypto - it’s to control who profits from it.

Has the U.S. or other countries taken action against Iran’s crypto mining?

Yes. The U.S. Treasury Department and Israeli intelligence have identified and sanctioned multiple Iranian crypto wallets linked to IRGC operations. In 2024, two mining companies tied to the IRGC were added to U.S. sanctions lists. However, these actions have had limited effect because the mining infrastructure is inside Iran, protected by military forces, and funded by domestic energy resources. Sanctions target the money, not the power grid - and the IRGC still controls both.