What is TDM (TDM) crypto coin? The truth behind the fitness token with 99.9% price crash

Jan, 29 2026

Jan, 29 2026

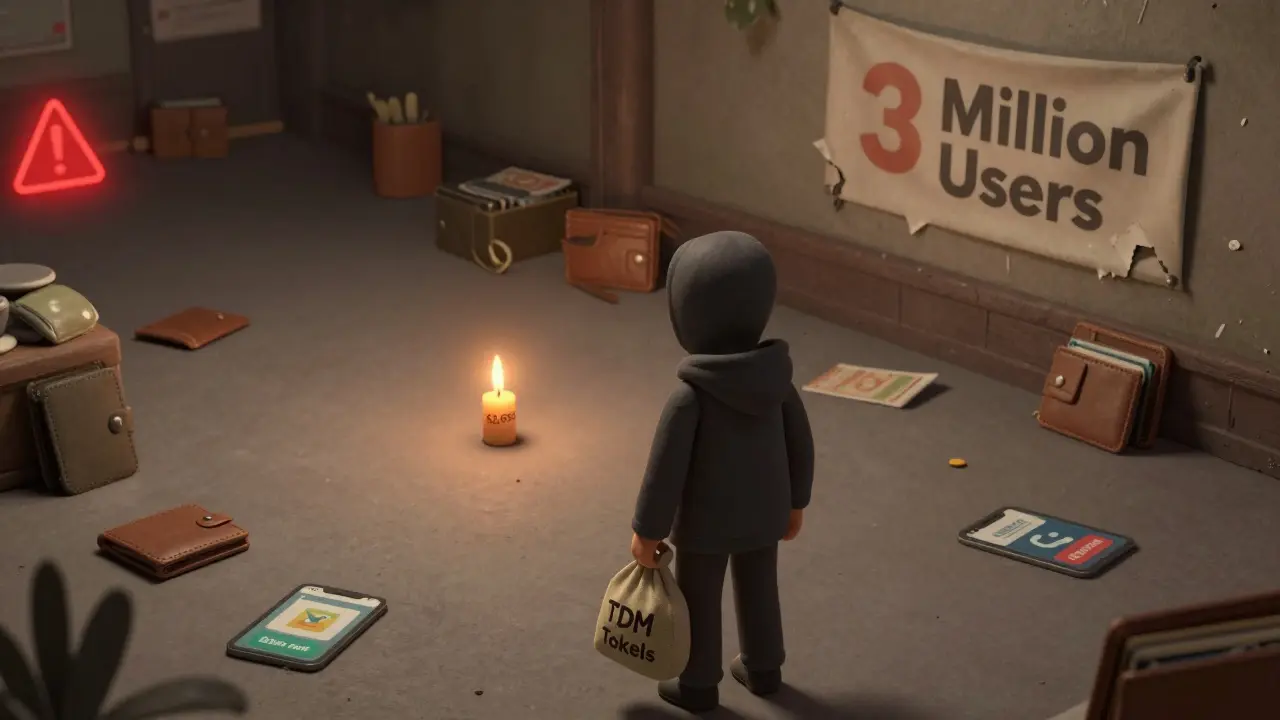

What is TDM crypto? If you’ve seen ads on Instagram or TikTok promising you a share in a fitness app’s profits just by buying a token, you’re not alone. But here’s the reality: TDM isn’t a breakthrough in health tech or blockchain innovation. It’s a speculative token that lost 99.9% of its value in under a year, has zero trading volume, and likely doesn’t even work the way its promoters claim.

What TDM claims to be

TrainingDietMax (TDM) is a cryptocurrency token built on the Solana blockchain. Launched in 2024, it was marketed as a way to invest in a fitness and nutrition app with over 3 million users. The pitch was simple: buy TDM tokens, and you get a piece of the future profits from the app’s sales. The project said 20% of its valuation would be distributed as cryptocurrency, while the rest stayed with the founders.

They claimed the app lets people without bank accounts buy wellness programs using crypto. They posted screenshots of a mobile app, ran ads on Snapchat and TikTok, and built a social media following of over 650,000 across platforms. On paper, it sounded like a win-win: health-conscious users get affordable tools, investors get exposure to a growing market.

The numbers don’t add up

But the numbers tell a different story.

According to CoinMarketCap and Liquidity Finder, TDM’s all-time high was $0.3028 on September 2, 2024. By January 2026, it was trading at $0.00008. That’s a 99.9% drop. Not a correction. Not a market dip. A near-total collapse.

The total supply is around 94.9 million tokens, but only about 92.6 million are circulating. Sounds healthy? Not when you look at trading activity. On January 3, 2026, the entire 24-hour trading volume for TDM was $2,655 - and almost all of it happened on one exchange, Jupiter. That’s less than what some people spend on coffee in a week. CoinMarketCap showed $0 volume. That means for days, no one was buying or selling.

Market cap? It swung wildly between $8,000 and $118,000 depending on the source. That’s not volatility - it’s chaos. For comparison, Calo, a fitness token with real integration into workout tracking, has a market cap of $42 million. TDM is ranked #10,016 by market cap. It’s not just small. It’s practically invisible.

No real utility, no blockchain integration

The biggest red flag? The TDM token doesn’t do anything inside the app.

Users on Reddit and Twitter dug into the TrainingDietMax app on Google Play. It’s a basic diet tracker with only 10,000+ downloads - not 3 million. The app doesn’t accept TDM for payments. You can’t use tokens to unlock premium features. You can’t earn them by logging workouts. There’s no wallet inside the app. No blockchain connection. No integration at all.

One Trustpilot reviewer wrote: “The app crashes constantly. The premium features are locked behind a subscription that doesn’t even accept crypto.” Another user on Twitter called it: “A classic case of a project creating a token for an existing app with no blockchain integration whatsoever.”

That’s not innovation. That’s deception.

How to buy TDM - if you dare

If you still want to try buying TDM, here’s what you need:

- A Solana-compatible wallet (like Phantom or Solflare)

- SOL (Solana’s native coin) to pay for transaction fees

- Access to Jupiter or Raydium, two decentralized exchanges on Solana

- Technical know-how to swap tokens manually

For a beginner, setting this up takes 30 to 60 minutes. And even then, you’re stuck with a token that has almost no buyers. Try to trade more than $50 worth of TDM, and you’ll likely move the price by 15% or more because there’s so little liquidity. That’s not investing - that’s gambling on a dead market.

Who’s behind it? No one knows

There’s no team page. No LinkedIn profiles. No public founders. The official website (trainingdietmax.com) has a basic FAQ and nothing else. No whitepaper. No technical documentation. No roadmap. No contact email.

The project’s Twitter account (@trainingdietmax) hasn’t posted since October 2025. The app hasn’t been updated in months. Customer support? Nonexistent. People asking questions about token redemption or app bugs got no replies.

That’s not a startup. That’s a ghost.

Legal risks you can’t ignore

The U.S. Securities and Exchange Commission (SEC) has been cracking down on tokens that promise a share of future profits - especially when there’s no clear utility. TDM’s claim that investors get “a share in the proceeds from the future sale of the TDM app” sounds exactly like an unregistered security.

Dr. Elena Rodriguez, a crypto analyst at the Blockchain Research Institute, said in December 2025: “Tokens with market caps under $100,000 and trading volumes below $5,000 typically lack sufficient liquidity for meaningful investment and often exhibit pump-and-dump characteristics.” That’s TDM in a nutshell.

And it’s not just speculation. If the SEC ever decides to act, TDM could be labeled an illegal security. That means anyone holding it could lose everything - and potentially face legal trouble for participating in an unregistered offering.

Why this keeps happening

TDM isn’t unique. It’s part of a growing trend: fitness apps launching tokens with no real blockchain use. These projects rely on hype, influencer ads, and false claims about user numbers. They target people who want to “get rich quick” by investing in something that sounds healthy and wholesome.

But the data doesn’t lie. The average small-cap crypto token (market cap $100K-$1M) dropped 72% during the same period TDM lost 99.9%. That means TDM didn’t just follow the market - it collapsed far worse than nearly every other token.

Dr. Michael Chen from CryptoRisk Advisors put it bluntly in January 2026: “Tokens with market caps below $30,000, zero trading volume, and no verifiable utility have a 99.7% failure rate within 18 months.”

TDM is already past that 18-month mark. And it’s not just failing. It’s gone.

Bottom line: Don’t touch TDM

If you’re looking for a fitness-related crypto to invest in, look at Calo, Fitmint, or other projects with real user data, verified app integration, and active development. TDM has none of that.

It’s a token built on a lie. A marketing stunt disguised as innovation. A pump-and-dump scheme with a fitness-themed cover.

Don’t be the last person holding it.

Pamela Mainama

January 29, 2026 AT 08:24TDM was never about fitness. It was about turning hope into a commodity for people who just wanted to believe something good could happen to them.

And now they’re left with nothing but a wallet full of ghost tokens.

Edward Drawde

January 30, 2026 AT 07:13lol at people still talking about tdm like its a real thing. bro its a meme at this point. i bought 10k tokens in 2024 and now theyre worth less than my coffee.

Will Pimblett

February 1, 2026 AT 06:37Let me get this straight - you’re telling me a project with zero team, zero documentation, and an app that doesn’t even accept its own token somehow convinced 650k people it was legitimate?

Not a scam. Not a joke. A full-blown cultural failure.

And yet people still ask ‘how to buy it.’

Rico Romano

February 1, 2026 AT 17:14Only in America do you get rich people funding vaporware with influencer ads and call it ‘innovation.’ In Europe, we just call it fraud and jail the founders.

But hey, free market, right? Let the fools invest.

And then cry when they lose everything.

Tressie Trezza

February 3, 2026 AT 06:10I used to think crypto could change lives. Now I just see it as a mirror - it reflects exactly what people want to believe, not what’s real.

TDM didn’t fail because of bad tech.

It failed because people needed to believe in something that wasn’t there.

Calvin Tucker

February 3, 2026 AT 22:13The linguistic structure of the TDM whitepaper - or lack thereof - reveals a fundamental epistemological deficit in its design philosophy. Absence of verifiable ontological claims renders the token semantically inert, thereby collapsing its utility function into pure speculative noise.

Furthermore, the dissonance between projected user metrics (3M) and actual Google Play downloads (10K) constitutes a statistically significant anomaly, indicative of systemic deception.