Blockchain Compliance: What It Is, Why It Matters, and How It Affects You

When you use crypto, blockchain compliance, the set of rules and checks that ensure cryptocurrency use follows government laws. Also known as crypto regulation, it's no longer optional—it’s the invisible force shaping who can trade, where, and under what conditions. This isn’t about big corporations hiding money. It’s about your wallet being flagged because you used an unlicensed exchange, or your funds getting frozen because a coin you bought is tied to a sanctioned entity.

AML crypto, anti-money laundering rules applied to digital assets forces exchanges to know who you are. That’s why platforms like Changelly Pro aren’t available in the U.S. or U.K.—they can’t meet those requirements. Meanwhile, OFAC sanctions, U.S. government restrictions on people, companies, and countries tied to illegal activity have turned simple trades into legal risks. Russian users avoiding Garantex or Exved aren’t being paranoid—they’re avoiding criminal charges. Same goes for traders in Cuba or Syria, where the rules changed overnight in 2025.

And it’s not just about who you trade with. crypto seizure, when governments take control of digital assets is happening at record levels. The U.S. alone built a $17 billion Bitcoin reserve from confiscated coins. Angola shut down mining rigs because people were stealing electricity. If you hold privacy coins like Monero or Zcash, you’re not just protecting your privacy—you’re walking a legal tightrope. Governments see those coins as tools for hiding money, and they’re responding with tighter controls.

Blockfinex, SkullSwap, Kalata Protocol—these aren’t just risky platforms. They’re compliance nightmares. No audits, no KYC, no transparency. That’s why experts warn against them. They’re not just insecure—they’re likely violating rules that could get users caught in the crossfire. Even airdrops like CHIHUA or SUNI aren’t harmless freebies. If the token has no team or utility, claiming it might mean you’re unknowingly helping a scam that skirts regulation.

Blockchain compliance isn’t slowing crypto down—it’s forcing it to grow up. The exchanges that survive are the ones that play by the rules. The coins that thrive are the ones that don’t hide. The users who stay safe are the ones who understand what’s allowed—and what’s not.

Below, you’ll find real reviews, breakdowns, and warnings from people who’ve been burned—or avoided disaster—by ignoring these rules. Whether you’re trading on TON, mining in Africa, or holding tokenized stocks, what you’re about to read could save you from losing more than just money.

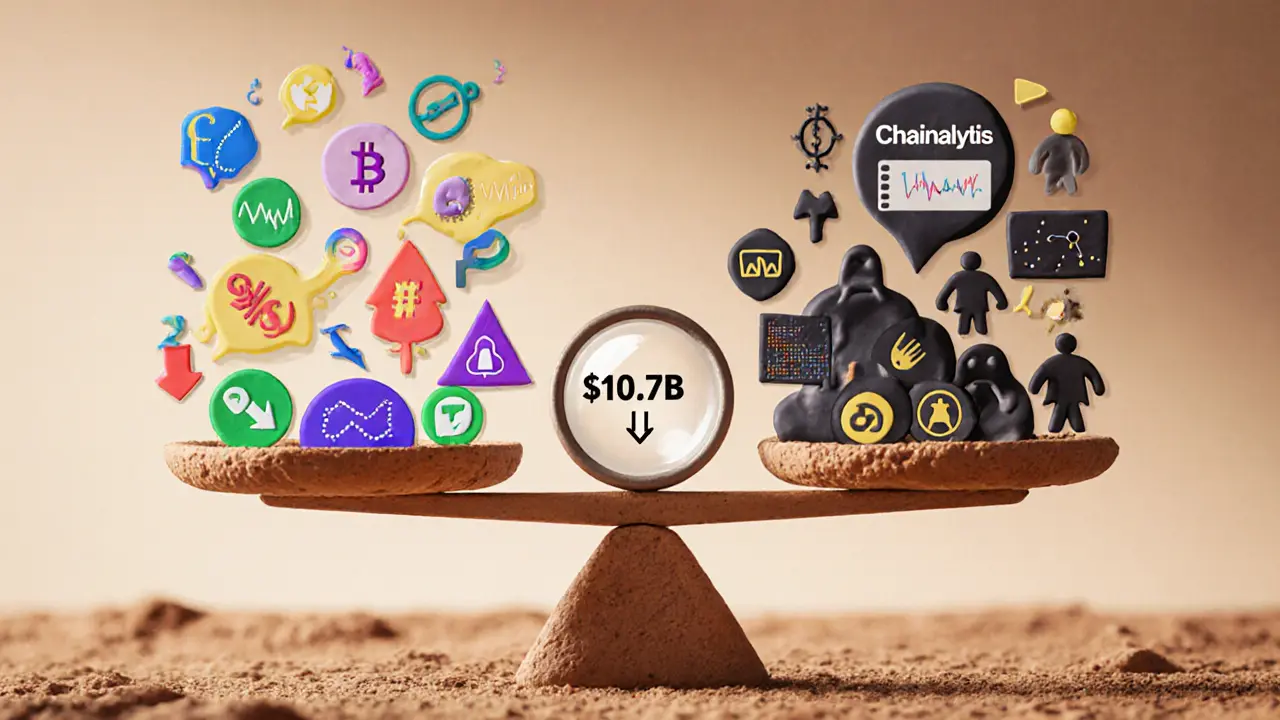

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

Crypto enforcement in 2024-2025 shows declining fraud but rising complexity. TRON’s illicit activity dropped 50% after targeted collaboration, while global regulation remains uneven. Real progress is happening - but only where law enforcement works with blockchain firms.