Crypto Enforcement: How Governments Seize Crypto and What It Means for You

When you hear crypto enforcement, the actions taken by governments to regulate, track, or seize cryptocurrency assets. Also known as cryptocurrency regulation, it's no longer just about rules—it's about power, control, and real-world consequences. This isn’t theoretical. In 2024, the U.S. government alone seized over $17 billion in Bitcoin, creating a strategic reserve. Countries like Angola banned mining outright because power grids were collapsing. Russia cracked down on unlicensed exchanges, and Cuba saw new sanctions tighten around digital assets. Crypto enforcement isn’t coming—it’s already here.

It’s not just about big players. If you’re holding privacy coins like Monero, a cryptocurrency designed to hide transaction details and protect financial privacy, you’re already in the crosshairs. Regulators see anonymity as a red flag. Exchanges like Garantex and Exved got shut down not because they were scams—but because they didn’t comply with anti-money laundering rules. Even legitimate users can get caught in the net if their wallet interacts with a flagged address. Asset forfeiture doesn’t require a conviction. In many places, authorities can seize crypto just by proving it was involved in a suspicious transaction.

And it’s not just the U.S. or Europe. Countries like Syria and Cuba are being treated differently under OFAC rules, creating legal minefields for traders. Meanwhile, platforms like Blockfinex and SkullSwap vanish because they lack audits or transparency—making them easy targets for enforcement actions. Even airdrops like CHIHUA or SUNI aren’t safe; if they’re unregistered, claiming them could tie you to an illegal activity. The line between a free token and a regulatory violation is thinner than you think.

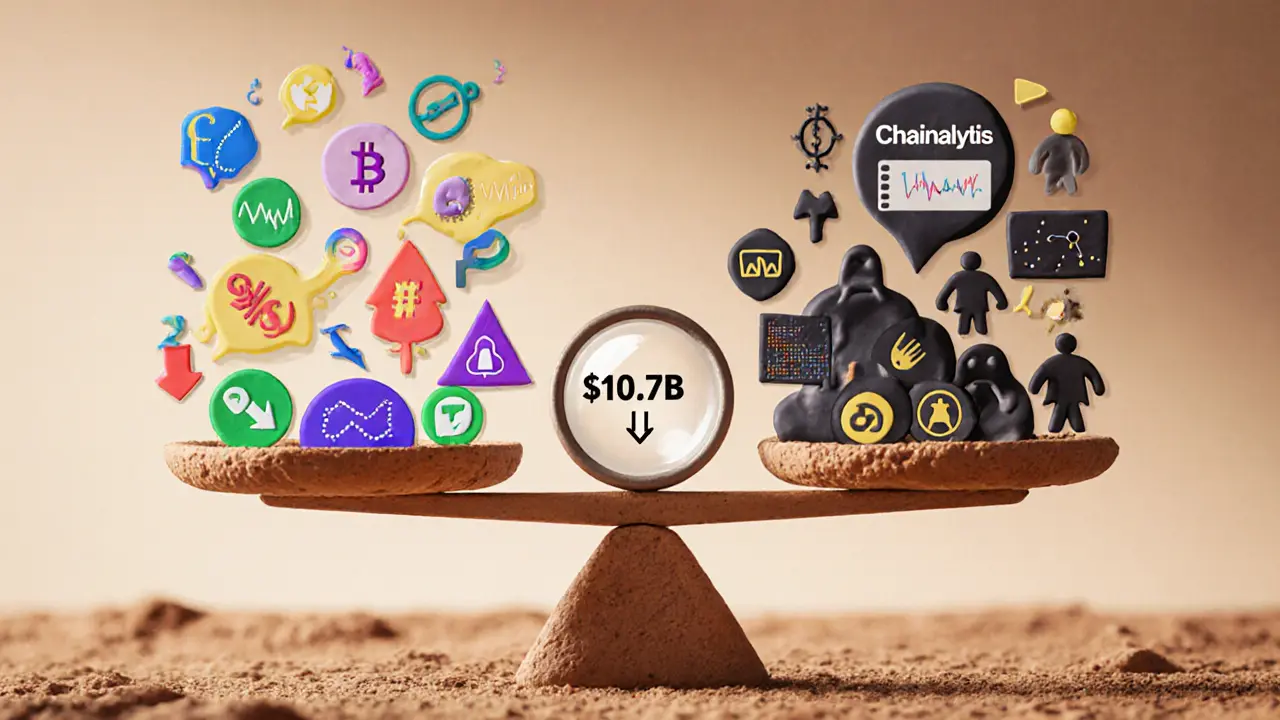

What does this mean for you? If you’re trading, farming yield, or holding crypto, you’re part of a system that’s being watched, measured, and policed. Blockchain activity isn’t anonymous—it’s traceable. Active addresses, transaction patterns, and wallet histories are all data points regulators use. You don’t need to be a criminal to be targeted. You just need to be on the wrong side of a rule you didn’t know existed.

Below, you’ll find real-world examples of how crypto enforcement plays out—from seized mining rigs in Angola to tokenized stocks flagged by compliance teams. You’ll see which exchanges got banned, which coins got labeled risky, and how people lost everything overnight. This isn’t a warning to stop using crypto. It’s a guide to using it without becoming a target.

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

Crypto enforcement in 2024-2025 shows declining fraud but rising complexity. TRON’s illicit activity dropped 50% after targeted collaboration, while global regulation remains uneven. Real progress is happening - but only where law enforcement works with blockchain firms.