Crypto Fraud: How Scams Work and How to Avoid Them

When you hear crypto fraud, the deliberate deception of individuals to steal cryptocurrency through fake platforms, forged airdrops, or manipulated smart contracts. Also known as crypto scams, it’s not just about losing money—it’s about losing trust in an entire system designed to be open and transparent. Every year, billions vanish because someone clicked a link, trusted a fake website, or chased a promise of free tokens. This isn’t theoretical. Look at CHIHUA or SUNI airdrops—both had zero real project behind them, yet people rushed to claim tokens that didn’t exist. That’s crypto fraud in action.

Scammers don’t need fancy tech. They use what works: urgency, fake legitimacy, and greed. You’ll see a fake airdrop, a fraudulent distribution of non-existent tokens designed to steal private keys or wallet access. Also known as free token scams, these often appear on social media, Telegram groups, or even fake CoinMarketCap pages. They’ll ask you to connect your wallet. One click, and your funds are gone. Then there are unregulated exchanges, crypto platforms with no audits, no transparency, and no legal oversight that disappear with user funds. Also known as rug pull exchanges, they’re why SkullSwap and Blockfinex got warned against—no audits, no community, no future. These aren’t just risky—they’re designed to fail after they’ve taken your money. And when governments seize crypto, like the U.S. did with its $17 billion Bitcoin reserve, it’s often because those coins were stolen in the first place.

Phishing attacks, fake customer support, and cloned websites are everywhere. One minute you’re on what looks like Changelly Pro, the next you’ve entered your seed phrase into a mirror site. Even legitimate-sounding projects like Levana Protocol or Kalata Protocol turned out to be dead ends with zero volume and silent teams. The red flags are always there: no team, no audits, low liquidity, and promises that sound too good to be true. If someone says "free crypto" without you doing anything, walk away. If a DEX has less than $100k in liquidity, assume it’s a trap. If the whitepaper reads like a tweet, it’s not worth your time.

There’s no magic shield against crypto fraud. But there are simple habits: always verify URLs, never connect your wallet unless you’re 100% sure, check contract addresses on Etherscan or BscScan, and ignore any airdrop that asks for your private key. The posts below break down real cases—SkullSwap, Blockfinex, CHIHUA, and more—so you can spot the same patterns before you get burned. You won’t find hype here. Just facts, warnings, and what actually happened to people who trusted the wrong thing.

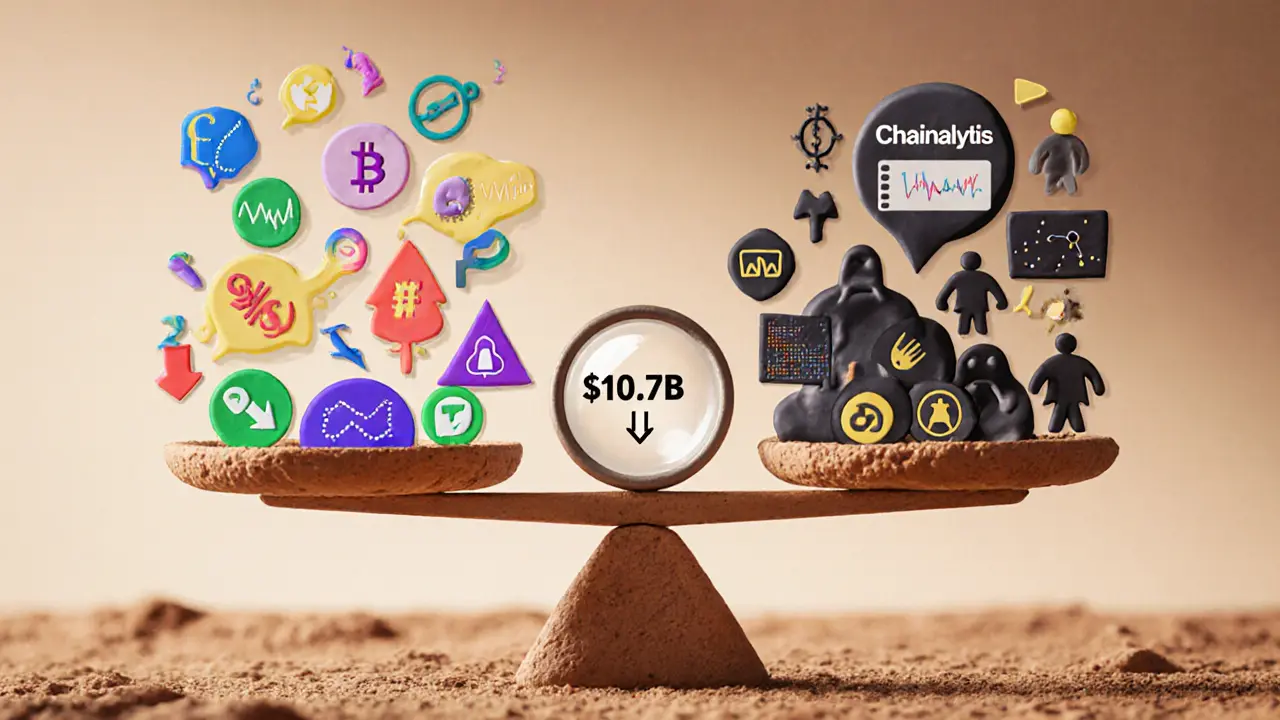

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

Crypto enforcement in 2024-2025 shows declining fraud but rising complexity. TRON’s illicit activity dropped 50% after targeted collaboration, while global regulation remains uneven. Real progress is happening - but only where law enforcement works with blockchain firms.