Crypto Regulation 2025: What’s Changing and Who It Affects

When we talk about crypto regulation 2025, the growing set of government rules controlling how cryptocurrency is used, taxed, and enforced. Also known as digital asset oversight, it’s no longer just about stopping scams—it’s about controlling money flows, seizing assets, and deciding who gets to trade what. This isn’t theory. In 2025, governments are acting fast: the U.S. built a $17 billion Bitcoin reserve from seized coins, Angola jailed miners for stealing power, and Cuba’s crypto access got tighter while Syria’s loosened. If you hold crypto, you’re already affected.

One major shift is how asset forfeiture, the legal process where governments take crypto from individuals or companies without conviction. Also known as crypto confiscation, it’s now routine in the U.S., EU, and parts of Asia. You don’t need to be accused of a crime—just linked to a sanctioned exchange like Garantex or Exved, and your coins can vanish. Then there’s privacy coins, tokens like Monero and Zcash designed to hide transaction details. These are under fire because regulators can’t track them, making them targets for bans or restrictions even in countries with otherwise friendly rules. Meanwhile, crypto exchanges, platforms where you buy, sell, or trade digital assets. Also known as DEXs or CEXs, they’re being forced to choose: comply with KYC and AML rules or vanish from global markets. Blockfinex, SkullSwap, and Levana Protocol got ignored or flagged because they didn’t play by the new rules. Even STON.fi and Changelly Pro, which are clean and fast, aren’t available everywhere because of regional compliance.

What you’ll find in the posts below isn’t just a list of news—it’s a map of real consequences. You’ll see how El Salvador’s Bitcoin experiment collapsed, why Angola banned mining outright, and how Portugal still lets you trade tax-free. You’ll learn which exchanges are legally risky for Russians, why fake airdrops like CHIHUA and SUNI are everywhere, and how NFT tickets and tokenized stocks like BAon fit into this new regulatory world. This isn’t about hype or speculation. It’s about survival: knowing where your coins are safe, who’s watching, and what happens if you get caught on the wrong side of a law that changed overnight.

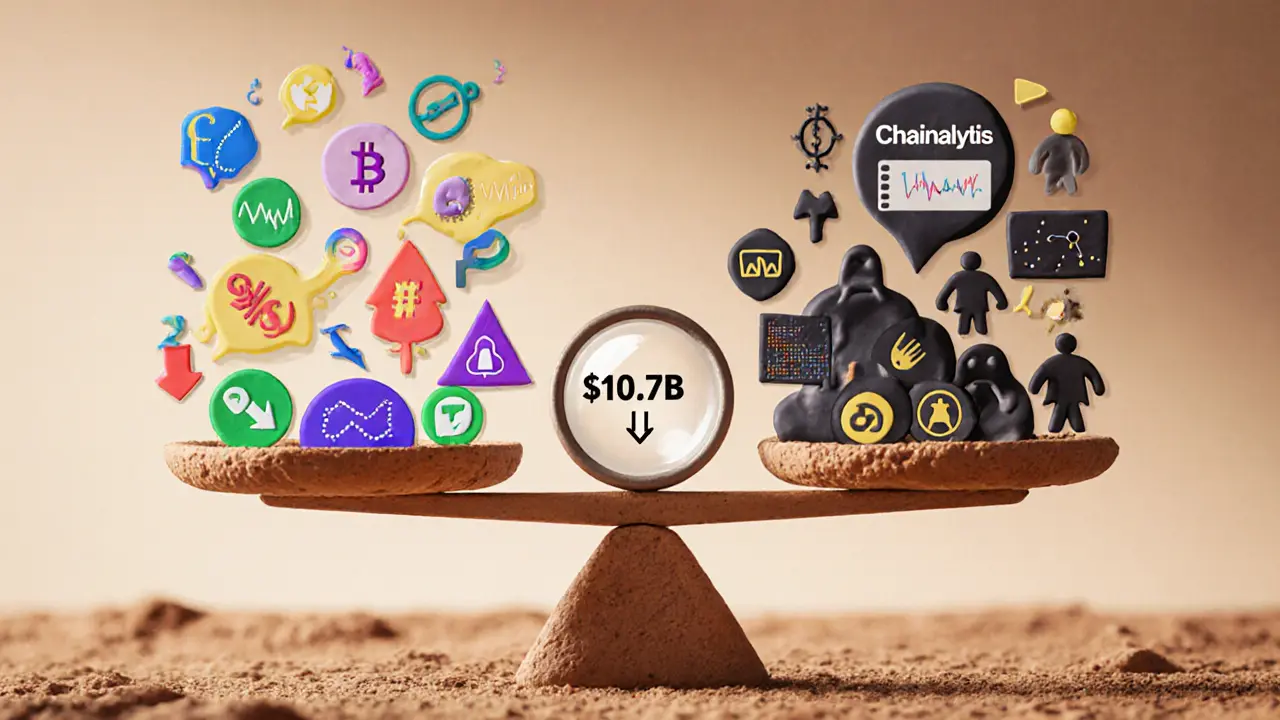

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

Crypto enforcement in 2024-2025 shows declining fraud but rising complexity. TRON’s illicit activity dropped 50% after targeted collaboration, while global regulation remains uneven. Real progress is happening - but only where law enforcement works with blockchain firms.