Cryptocurrency Regulations: What You Need to Know About Global Rules and Compliance

When it comes to cryptocurrency regulations, the legal rules that govern how digital assets can be bought, sold, taxed, or used. Also known as crypto compliance, these rules determine whether you can trade on Binance in the U.S., claim an airdrop in Algeria, or use Tornado Cash without legal risk. There’s no global standard—what’s legal in Germany is a crime in Algeria, and what’s taxed in Taiwan is ignored in Iran.

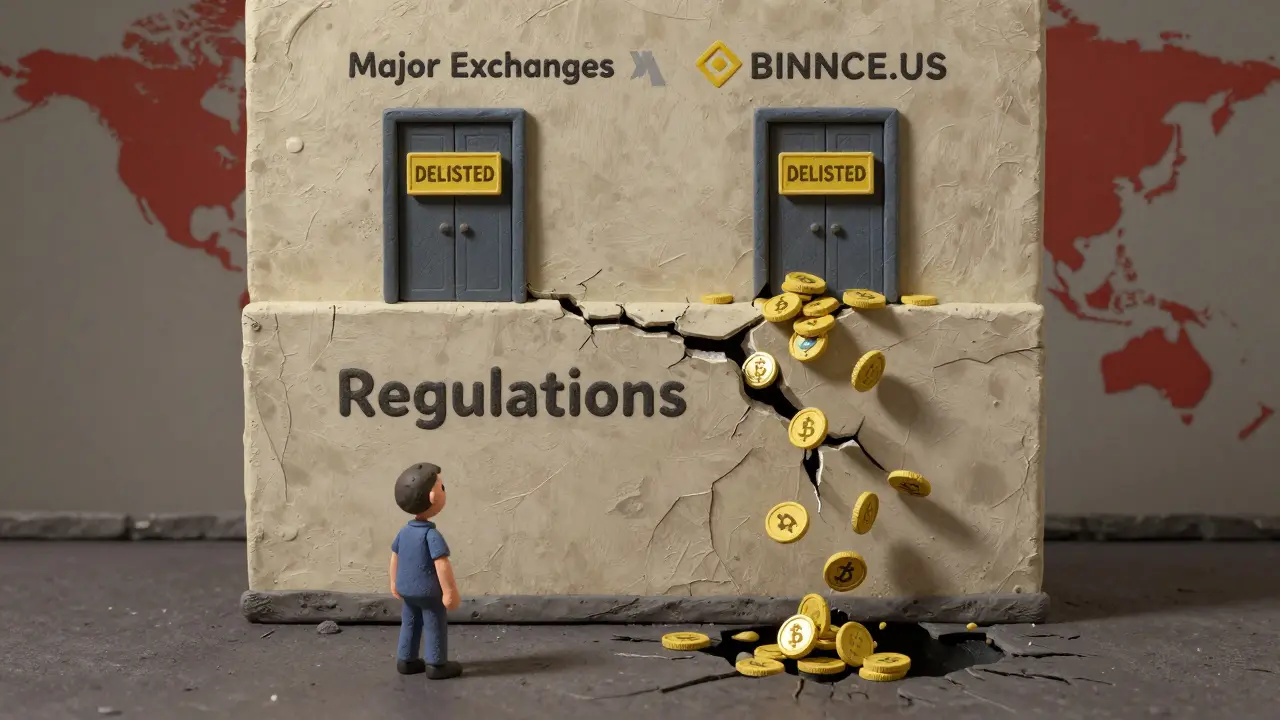

Crypto exchange restrictions, rules that block or limit which platforms you can use based on your location. Also known as regional trading bans, they’re why MEXC isn’t available in Canada and why CashTelex has no users—it’s not just sketchy, it’s likely illegal everywhere. These restrictions tie directly to blockchain regulation, how governments enforce rules on transparency, identity, and financial crime. Also known as AML/KYC laws, they’re behind why German exchanges need BaFin licenses and why StraitsX USD can’t be used in the U.S. or EU. Even privacy tools like crypto mixers are caught in this net—Tornado Cash was sanctioned, then partially lifted, but its devs still face prosecution. That’s not a glitch—it’s policy.

Crypto tax rules, how governments track and charge you on crypto profits. Also known as virtual asset taxation, they’re why Taiwan demands 20% income tax on gains and why you need to track every cost basis, even for tiny trades. Meanwhile, Iran uses Bitcoin mining to bypass sanctions entirely, turning surplus power into cash—proving that regulation doesn’t stop crypto, it just changes how it flows.

What you’ll find below isn’t a list of laws—it’s a real-world map of what’s allowed, what’s risky, and what’s outright banned. From the full crypto ban in Algeria to the MAS-regulated stablecoin in Singapore, from the Tornado Cash court battle to the unlicensed exchanges that vanish overnight, these posts show you the rules that actually matter. No theory. No fluff. Just what you need to know before you trade, invest, or claim your next airdrop.

Privacy Coin Regulations and Delisting: What You Need to Know in 2025

Privacy coins like Monero and Zcash are being delisted globally due to strict anti-money laundering rules. Learn why exchanges removed them, where they're still usable, and what alternatives exist in 2025.