Delisting in Crypto: What It Means and Why It Matters

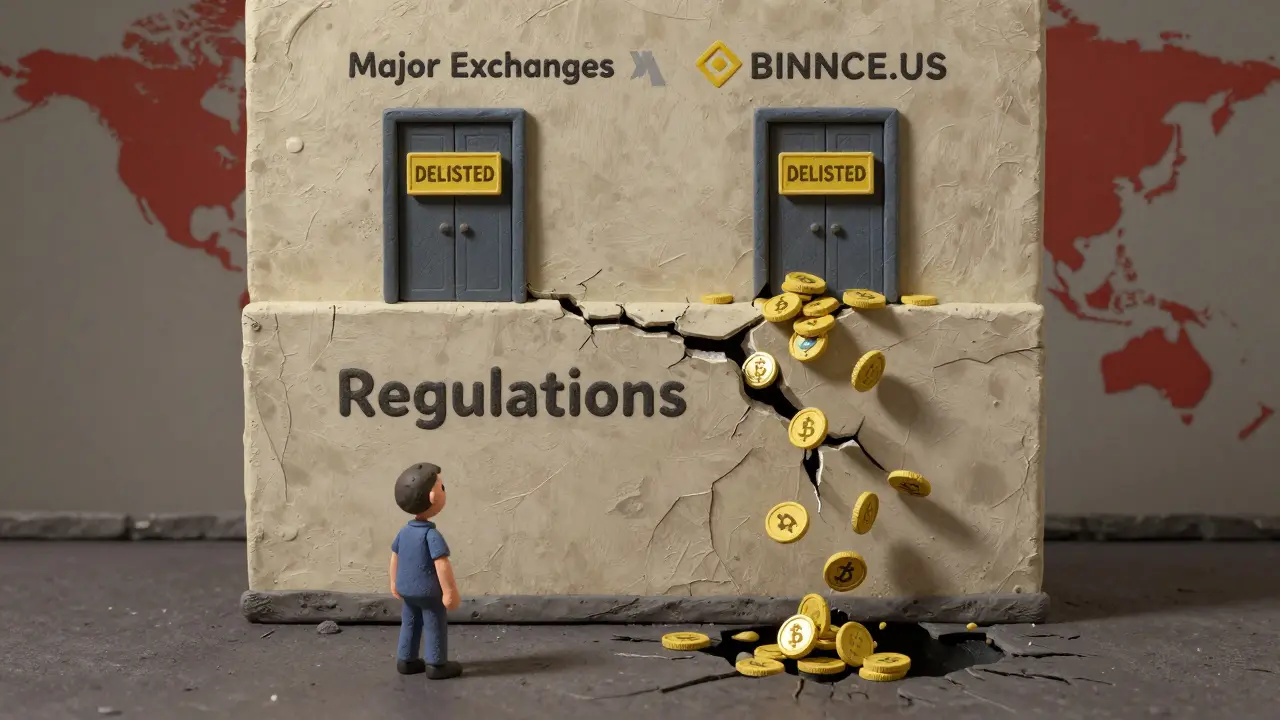

When a cryptocurrency gets delisted, the removal of a crypto asset from a trading platform. Also known as de-listing, it means you can no longer buy or sell that coin on that exchange—often the only place it was liquid. This isn’t just a backend update. It’s a signal. Sometimes it’s a red flag. Other times, it’s just regulation catching up.

Delisting doesn’t happen randomly. It’s usually tied to crypto exchange, a platform where users trade digital assets. Also known as cryptocurrency exchange, it’s the gatekeeper between you and the market. Exchanges like MEXC, Binance, or MDEX keep their listings tight. If a coin has zero trading volume, like Empower (MPWR) or SkullSwap, or if it’s stuck in legal gray zones, like Tornado Cash after sanctions, exchanges cut ties. They don’t want the risk. They don’t want the fines. They don’t want to be the one holding a dead asset.

And it’s not just about volume. crypto regulations, government rules that control how digital assets are traded and held. Also known as crypto compliance, they’re pushing exchanges to clean house. Germany requires BaFin licensing. Taiwan demands tax tracking. Algeria bans crypto outright. When laws change, exchanges react fast. Coins without clear legal footing—like CashTelex or BSC AMP—are the first to go. Even if a token has a big supply, like GEAR or BAMP, if no one’s trading it and no one’s building on it, it’s a sitting duck.

Delisting doesn’t mean the coin dies. But it does mean it’s harder to sell, harder to get price data, and harder to trust. Smog (SMOG) still trades on small DEXs after crashing 98%. But who wants to hold something no major exchange supports? That’s the real cost: liquidity vanishes. Trust evaporates. And suddenly, your holdings turn into digital ghosts.

What you’ll find below are real cases—coins that got pulled, exchanges that vanished, and projects that never recovered. You’ll see how a lack of utility, zero community, or shady origins leads to the same end: delisting. This isn’t theory. It’s what’s already happened. And it’s happening again.

Privacy Coin Regulations and Delisting: What You Need to Know in 2025

Privacy coins like Monero and Zcash are being delisted globally due to strict anti-money laundering rules. Learn why exchanges removed them, where they're still usable, and what alternatives exist in 2025.