Crypto Insights for November 2025: Airdrops, Exchanges, and Blockchain Trends

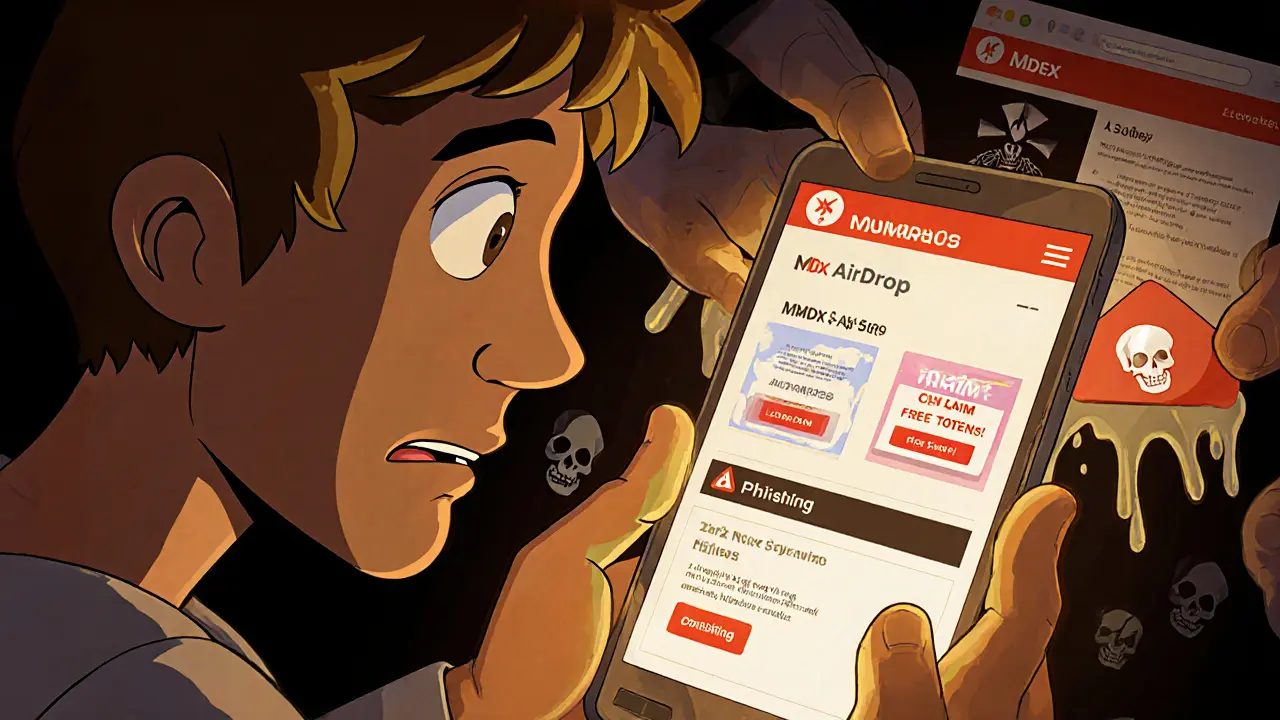

When navigating the crypto world in late 2025, you’re not just chasing tokens—you’re trying to separate real innovation from outright scams. crypto airdrop, a distribution of free tokens to wallet holders, often used to bootstrap adoption or reward early users. Also known as free token giveaway, it’s become a magnet for fraudsters who mimic legitimate projects like Mdex or Gamestarter. Most "free MDX" or "CHIHUA" airdrops in November 2025 had zero supply, no team, and no future—just phishing links. Meanwhile, legitimate opportunities like the SUNI campaign offered tokens with no value, reminding us that just because something is free doesn’t mean it’s worth claiming.

crypto exchange, a platform where users trade digital assets, ranging from simple swaps to complex leveraged markets. Also known as cryptocurrency trading platform, it’s where most people interact with blockchain daily. In November, reviews exposed dangerous platforms like Blockfinex and SkullSwap—lacking audits, transparency, or real volume. Others like STON.fi v2 and Changelly Pro stood out for speed, low fees, and clear rules. Russian users were warned off sanctioned exchanges like Garantex, while U.S. and U.K. traders found Changelly Pro and MEXC off-limits. The message? Not all exchanges are created equal, and your safety depends on knowing who’s behind the interface.

Behind these exchanges and airdrops lies deeper tech. blockchain privacy, the use of cryptographic methods like stealth addresses to hide transaction details and protect user identities. Also known as anonymous blockchain, it’s why Monero remains a top choice for journalists and activists. Unlike Bitcoin, where every transfer is public, privacy coins make it nearly impossible to trace who sent what to whom. This isn’t just about secrecy—it’s about financial freedom in places with high inflation or oppressive regimes. At the same time, governments seized over $17 billion in crypto, showing how tightly regulation is tightening around anonymity.

Then there’s DeFi—the engine powering yield farming, lending, and liquidity pools. Cream Finance and Sphynx Labs tried to offer multi-chain lending, but their low volume and unaudited code made them risky bets. Yield farming promised high APYs, but impermanent loss and gas fees ate into profits fast. And if you didn’t understand blockchain oracles, external data sources that feed real-world information like prices or weather into smart contracts. Also known as data bridges for blockchains, they’re the reason DeFi can work at all. Without Chainlink or similar oracles, smart contracts couldn’t know if a stock price changed or a flight was delayed. They’re invisible, but essential.

November 2025 didn’t bring flashy breakthroughs—it brought clarity. You saw which projects were built to last and which were just hype wrapped in a whitepaper. You learned that a low token price doesn’t mean a good deal—it often means a dead project. You saw how El Salvador’s Bitcoin experiment collapsed under technical and political pressure, and how Portugal quietly became one of the best places to hold crypto long-term. You learned that active addresses and on-chain metrics matter more than social media noise. And you saw that the real winners aren’t the ones chasing free tokens—they’re the ones who understand the infrastructure underneath.

Below are the deep dives, reviews, and warnings from November 2025. No fluff. No guesses. Just what happened, who got burned, and who stayed safe.

MDX Airdrop by Mdex: What You Need to Know in 2025

There is no active MDX airdrop from Mdex in 2025. Learn how to earn MDX tokens safely, spot fake airdrop scams, and understand the real ways to participate in the Mdex ecosystem.

Stealth Addresses in Privacy Coins: How Monero Keeps Your Transactions Private

Stealth addresses in privacy coins like Monero create one-time, untraceable addresses for each transaction, hiding the recipient's identity on the blockchain. Unlike Bitcoin, they prevent linking payments to a user's wallet, offering true financial privacy.

MEXC Crypto Exchange Review 2025: Fees, Altcoins, and Leverage Explained

MEXC is a top crypto exchange for altcoins and high-leverage trading, offering 3,000+ trading pairs, zero maker fees, and up to 500x leverage. Not available in the U.S. or Canada, but ideal for experienced traders seeking diversity and low costs.

What is Cream Finance (CREAM) Crypto Coin? A Clear Guide to DeFi's Multi-Chain Lending Protocol

Cream Finance (CREAM) is a multi-chain DeFi lending protocol that focuses on longtail crypto assets others ignore. Learn how it works, why its tokenomics are controversial, and who should use it.

SkullSwap Crypto Exchange Review: Is This Fantom DEX Worth Using in 2025?

SkullSwap is a nearly inactive Fantom DEX with minimal liquidity, no audits, and zero community support. Avoid it for trading - use SpookySwap or Uniswap instead.

About Us

BlockGem is your trusted hub for crypto insights, coin reviews, exchange comparisons, and airdrop tracking. Learn blockchain basics, security tips, and smart investing strategies from David Terry in Seattle.

Terms of Service

Terms of Service for BlockGem, an informational crypto blog offering insights on coins, exchanges, airdrops, and blockchain. Use of robdiamond.net is governed by U.S. law and disclaims liability for inaccurate or outdated content.

Privacy Policy

BlockGem's Privacy Policy explains how we collect and use data on robdiamond.net. No personal info stored. GDPR and CCPA compliant. Learn about cookies, analytics, and your rights.

CCPA

Understand your CCPA/CPRA rights at BlockGem. Learn how to access, delete, or opt out of the sale of your personal information. No registration required. Updated June 2024.

Contact

Contact BlockGem for questions about crypto coins, exchanges, airdrops, or blockchain insights. Reach David Terry at [email protected] or use our contact form.

What is StraitsX USD (XUSD) Crypto Coin? A Complete Guide to the MAS-Regulated Stablecoin

StraitsX USD (XUSD) is a MAS-regulated, USD-pegged stablecoin built for fast, low-cost payments across Southeast Asia. Fully backed by cash reserves and audited monthly, it's ideal for businesses in ASEAN but not available in the U.S. or EU.

Minter (BSC) Crypto Exchange Review: What You Need to Know in 2025

There is no crypto exchange called Minter (BSC). Learn what the term really means, how token minting works on BSC, and which real platforms to use instead - plus how to avoid scams in 2025.